How FHA Loans Help First-Time Homebuyers Break Into the Market

First-Time Buyer? FHA Loans Might Be Your Secret Weapon

If buying your first home feels a little like trying to summit Everest with a backpack full of avocado toast and student debt, you’re not alone. Between high prices, rising rates, and the eternal “Do I have enough saved?” spiral, it’s no wonder many would-be buyers feel stuck.

But here's the part they don’t talk about enough: FHA loans are built for exactly this moment.

Designed with first-time buyers in mind, FHA loans exist to knock down the two biggest barriers: your down payment and your monthly payment.

Let’s unpack how they do that and why they’re one of the smartest and underutilized tools in the market right now.

Buying Your First Home Is Harder Than Ever (We Get It)

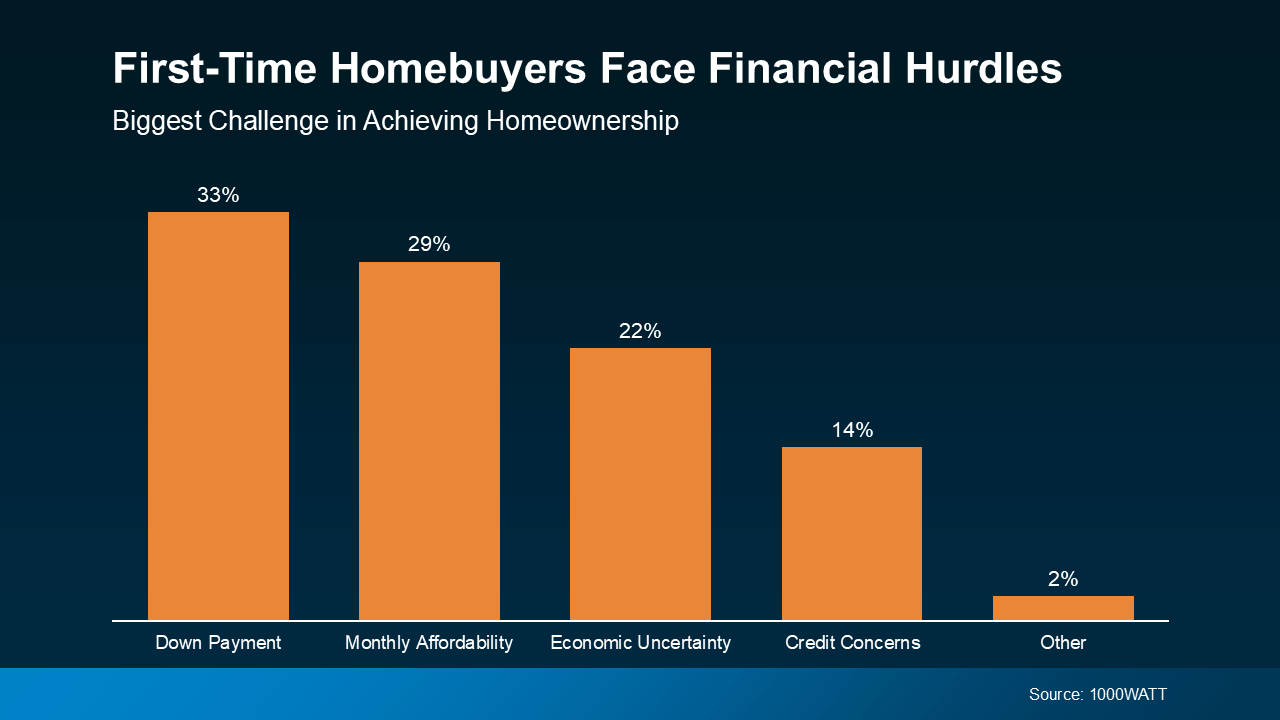

Even the most motivated buyers are feeling the pressure. According to a recent survey from 1000WATT, the top two concerns for first-timers are:

- Saving enough for a down payment

- Affording monthly mortgage payments at today’s prices and interest rates

Sound familiar?

This isn’t just about sticker shock—it’s about financial strain that can turn your homebuying dream into a very long waiting game.

FHA Loans: The Fast Track to “You’re Approved”

Here’s where the FHA (Federal Housing Administration) steps in to play hero. Their loans are specifically tailored to help people who:

- Don’t have 20% down saved (or even close)

- Might not have perfect credit

- Need flexibility on debt-to-income ratios

How flexible are we talking?

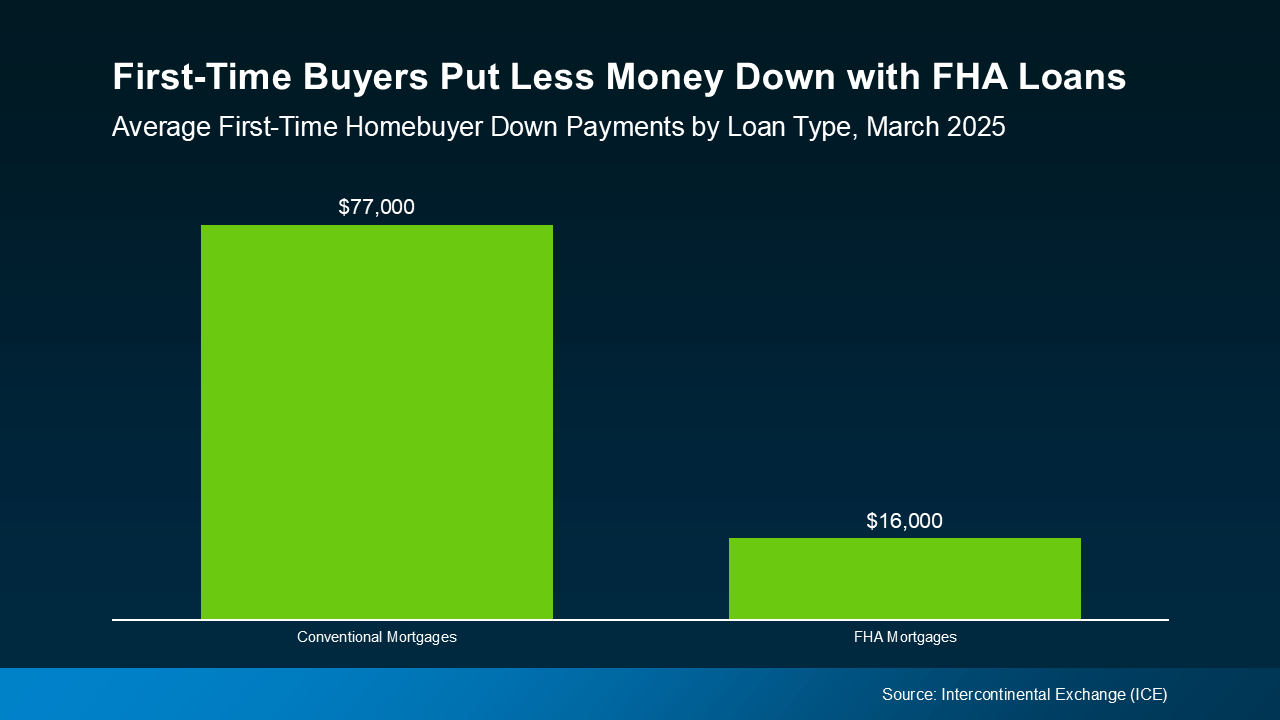

🟢 The average down payment for first-time buyers using an FHA loan is $16,000, according to Intercontinental Exchange (ICE).

🔴 Compare that to a typical $77,000 down with a conventional loan. Huge difference.

Oh, and that monthly payment that’s been haunting your dreams? Bankrate confirms that FHA rates are often slightly lower than conventional ones. That means lower upfront costs and potentially more affordable payments month to month.

If you’re still renting, you might want to check out this post on the long-term cost of renting while you're at it.

So, What’s the Catch?

There isn’t one. As long as you work with a knowledgeable lender who understands your unique financial situation. They’ll walk you through:

- How much you qualify for

- Your interest rate options

- The true monthly cost (including taxes + insurance)

- Whether an FHA loan or another program is a better fit

Pro tip: There are even local first-time buyer assistance programs that stack on top of FHA benefits.

You don’t have to do this alone and you definitely don’t have to wait. FHA loans make homeownership more accessible for first-timers who are ready but feeling overwhelmed.

✅ Smaller down payment

✅ Competitive interest rates

✅ Easier approval standards

Let’s talk about what’s possible. Want to explore your options? We can help connect with a trusted local lender today.

Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com

3007 W Horizon Ridge Pkwy, Ste. 210, Henderson, NV 89052

Categories

Recent Posts