1st Quarter 2025 Las Vegas & Henderson Housing Market Update

Las Vegas & Henderson Housing Market Report • 1st Quarter, April 2025

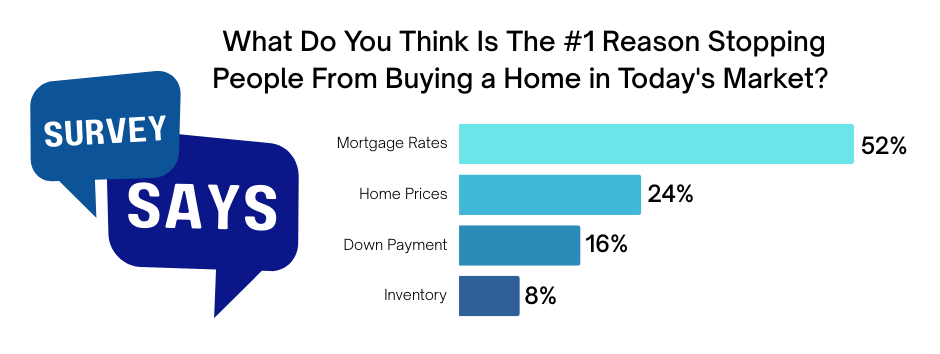

AND THE SURVEY SAYS...

We asked 11,000 people what they think is the #1 reason stopping home buyers from buying a home. Here’s what they said:

#1 Mortgage Rates

So far, mortgage rates in 2025 have been a bit volatile. The bond market thrives on certainty, and this year has been more of a roller coaster than a smooth ride. As certainty goes, so does the bond market. When investors sense potential downside in the equity market, they tend to shift toward bonds. That increased demand drives bond yields down—which often translates to lower mortgage rates.

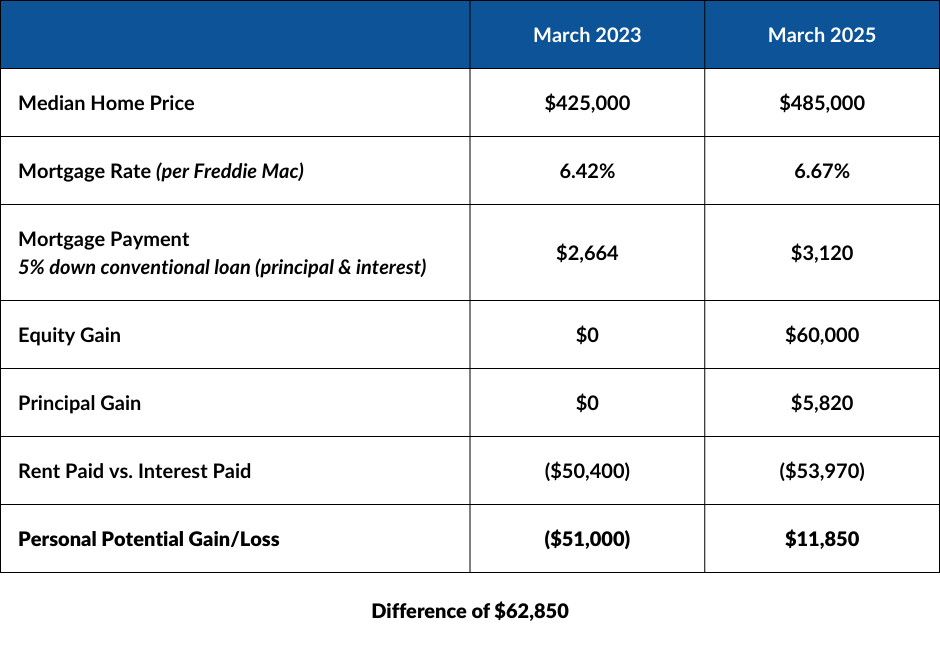

\Where else are you making or saving an average of $31,425 a year? Plus, the other added benefits of homeownership:

- Security of owning your own home: Priceless

- It's your home, you can do what you like: Priceless

- Making lifetime memories with your family: Priceless

#2 Home Prices

When we speak with buyers about home prices, we tend to hear two main responses:

- “I think home prices are going to fall,” usually based on a general assumption.

- “Homes are just too expensive for me to afford right now.”

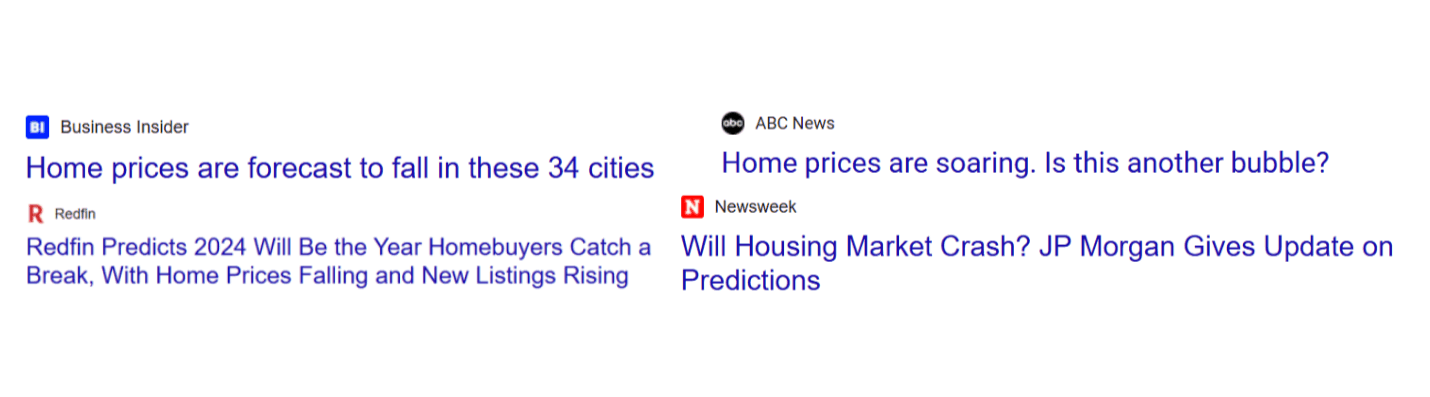

Why do buyers think prices will drop? Most of the time, it comes down to sensationalized headlines in the news or attention-grabbing posts on social media. These are designed to stop you mid-scroll and spark emotion.

We urge buyers to read the full articles and review the supporting data before making a major life decision based solely on a headline.

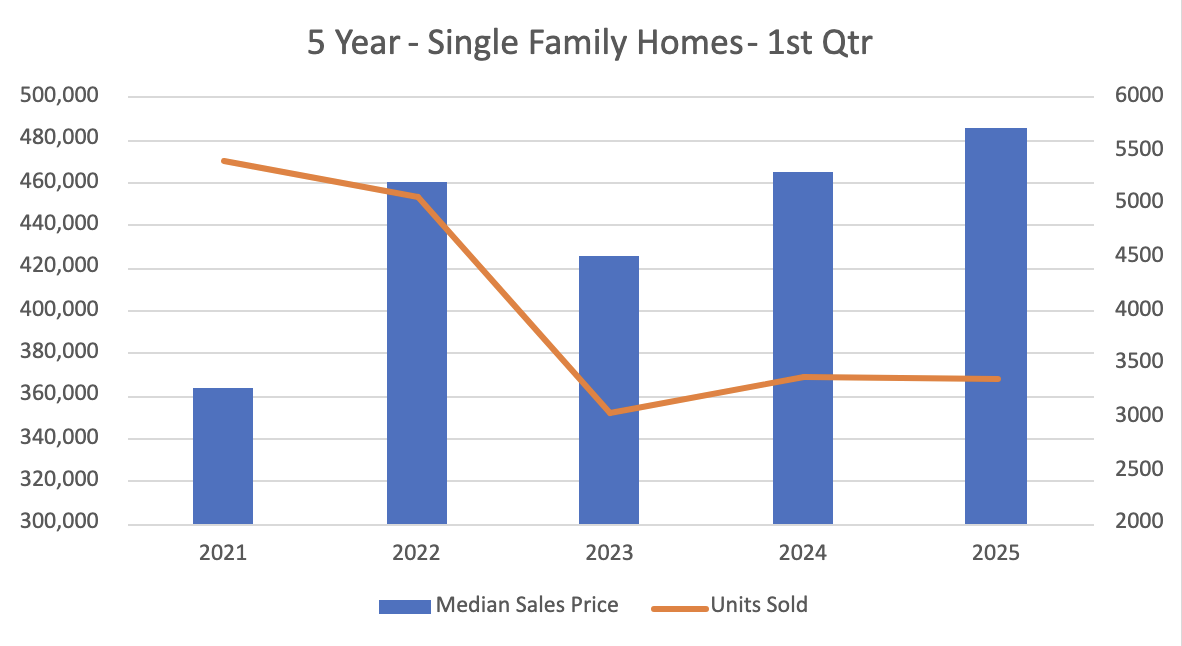

The graph below shows median home prices over the past five years. Prices dipped in 2023 but rebounded in 2024, hitting a median of $480,000. Since November 2024, prices have remained steady, ranging between $480,000 and $485,000.

What must happen for prices to fall? Inventory has to surpass demand. Buyer demand has been lower over the past 18 months, and inventory levels for resale homes are beginning to rise. According to JP Morgan, “Existing homes for sale have reverted to more normalized levels across several key Metropolitan Statistical Areas (MSAs), and new homes have become fairly plentiful,” said Michael Rehaut, head of U.S. Homebuilding and Building Products Research at J.P. Morgan. The article notes that new home inventory is now at its highest level since 2007. However, unlike 2007–2008, speculative building is not widespread. Builders are limiting speculative construction and instead offering mortgage rate incentives rather than cutting prices—especially in communities with Move-In Ready homes or slower sales.

As for affordability: Home prices truly are out of reach for many in Southern Nevada. Based on the latest data, only about 20% of households in the area earn a combined income of $115,000 or more—roughly what’s needed to qualify for a 95% conventional loan at today’s rates for a median-priced home of $485,000.

So, what’s the path forward? Some experts predict a slight dip in prices this summer, following trends in similar markets like Arizona and Texas. But looking ahead over the next three years, the expectation is for a more traditional appreciation rate of around 3% annually. There may be occasional dips, but overall, home prices are projected to continue on an upward trajectory.

You can only afford what you can afford. Unless you win the lottery or get a major raise, the reality is you may need to adjust your expectations—starting smaller to eventually grow into the home you envision. Today’s generation often expects their first home to check every box, but previous generations started with a modest “starter home” and moved up as equity and income grew. That might mean buying a smaller home with fewer amenities than the one you're currently renting.

Let’s say you purchased a small home in March 2023. By the end of 2025, assuming a 3% annual appreciation and using January 2025’s median price, your equity could reach $91,550. If you put that equity down on a median-priced home today, your principal and interest payment would be around $2,412—about $200 less than the estimated payment from 2023 with only 5% down. Today, for $425,000, the average home size is 1,450 sq ft, while the median home at $485,000 averages 1,815 sq ft.

In short, compromising on size now could be the smartest move. It gets you into homeownership, builds equity, and sets you up to purchase the home that truly fits your needs in 3–5 years—all while enjoying the other benefits of owning vs. renting.

#3 Down Payment

I’m saving up for a down payment—a noble goal, and one we fully support. But let’s be real: Americans aren’t exactly known for being great savers. It takes serious sacrifice to build up a sizable down payment, and many aren’t willing to go that far.

To save for a 5% down payment plus closing costs on a $425,000 home, you'd need around $28,000. That assumes you've already committed to buying a smaller home and cutting back elsewhere. If you had started saving $750 a month three years ago, you'd be ready to buy today. So, what did you give up? Did you rent a smaller place, lease a cheaper car, skip dining out—or some combination of all three?

If that’s not your path, here are some other options to explore:

- Down Payment Assistance Grants If your household income is at or below $120,840 (for 1–2 people) or $140,980 (for 3+), and you haven’t owned a home in the past three years, you could qualify for down payment assistance programs. These typically come with slightly higher mortgage rates—anywhere from 0.5% to 1% more than a traditional FHA loan (which requires 3.5% down)—but they can bridge the affordability gap.

- 401(k) or IRA You may be able to tap into your 401(k) or IRA to buy a home. Here’s a breakdown of how it works and the pros and cons.

- Gift Funds Got a family member who wants to help? One of our clients had parents who wanted to contribute but couldn’t offer cash up front. Instead, they partnered with their kids on the purchase, shared in the equity, and were eventually bought out. It was a win-win for both sides.

- Forced Saving Plans A forced savings plan—also called automatic savings or commitment investing—is all about setting up recurring transfers that build your savings without requiring willpower. For most households, real savings only come when you reduce a major expense like rent or transportation. Some young families choose to move in with relatives for a year. If you’re paying $2,000 in rent and can eliminate or reduce that expense, you could save enough for a down payment within a year.

#4 Available Homes on the Market

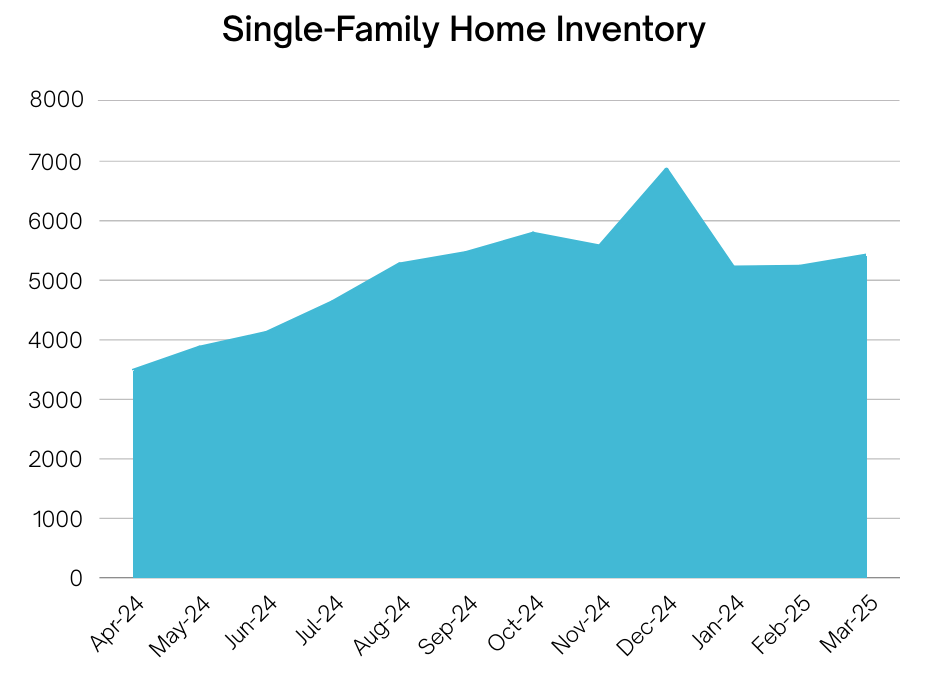

As we mentioned, inventory is already on the rise giving buyers more options and time to consider the home they want to purchase. The following graph shows inventory growth over the last year.

Inventory in March 2025 has increased by 1,940 homes compared to April 2024—a 55% jump. It seems the market may already be addressing this concern.

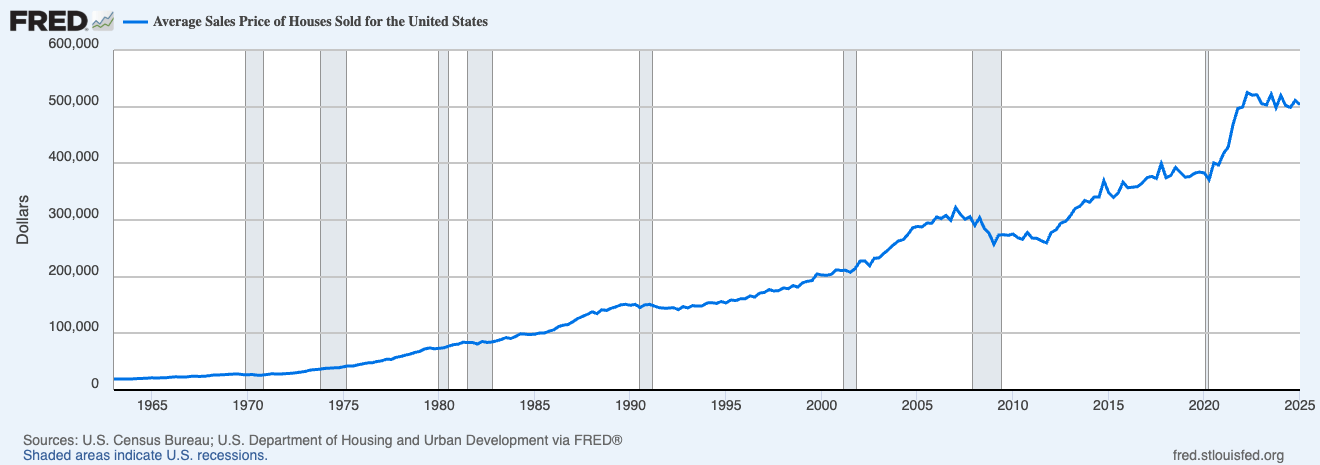

The #1 question we get asked: When is the right time to buy a home? For most of the last 50 years, the answer has been the same—five years ago.

Aside from a few key exceptions—the housing crash from 2008 to 2012 and the unique conditions of 2020 during COVID—home prices have generally followed an upward trend. This graph shows that, despite a few minor dips, prices have consistently risen over the past five decades.

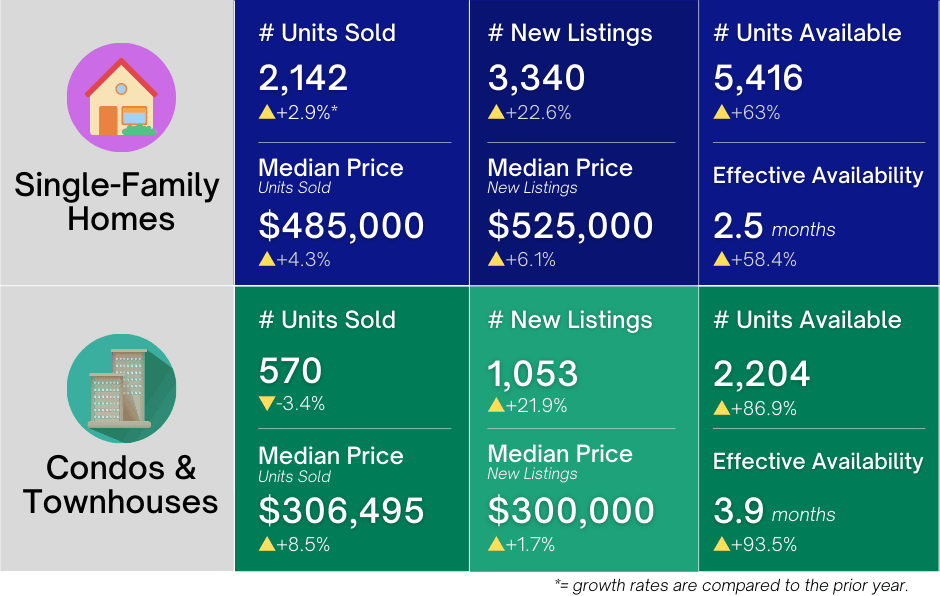

1st Quarter Housing Data for the Greater Las Vegas Market

What Sellers Should Know

We’ve covered what buyers are going through—now let’s talk to our sellers. Our advice hasn't changed much since the last market report, and for good reason: it still holds strong.

Price to Market Overpricing is one of the most costly mistakes a seller can make. In 99% of cases, sellers who price above market value end up selling for less than if they had priced correctly from the start. The data backs this up: 25% of buyers won’t even look at a home priced 10% over market, and only 10% will consider a home listed at 15% above. When a home lingers on the market, buyers start to wonder what’s wrong with it. That perception either discourages them entirely or convinces them it’s ripe for a deep discount.

Buyers Will Pay for Move-In Ready As we mentioned earlier, most buyers are cash-strapped. They’re more likely to pay a premium for a move-in ready home that doesn’t require out-of-pocket upgrades. Here's what matters most:

- Get Rid of the Ugly: Everyone has something they’ve grown blind to—outdated paint colors, clutter, yard neglect, or worn flooring. These shouldn’t be the buyer’s lasting impression. Clean, declutter, refresh, and make those small repairs you’ve been putting off.

- Update Key Items: Paint and flooring are #1. Buyers will often pay more for homes with fresh paint and modern, hard-surface flooring. Laminate wood plank remains highly desirable. Carpet in high-traffic areas like living rooms and hallways is less appealing.

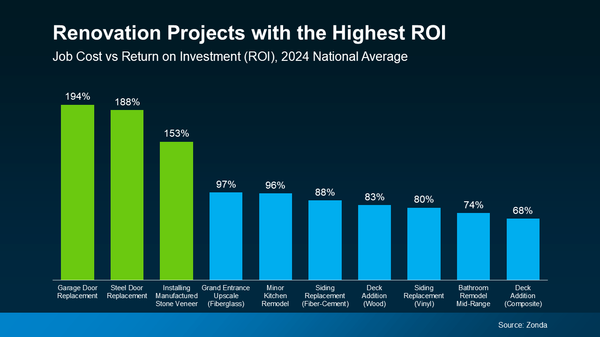

- Remodel Strategically: The upgrades that yield the best returns are kitchens, primary bathrooms, and outdoor living areas.

That said, not all upgrades pay off equally in every neighborhood. Our team can give you a community-specific assessment to help determine whether the market supports the improvements you're considering—whether you're looking to sell soon or simply invest wisely in your home.

Patience Homes are taking longer to sell than they did a few years ago. Currently, 56.9% of homes are selling within 30 days—but that also means nearly half are sitting longer.

Expect Negotiations Buyers are negotiating harder, especially under the $500,000 mark. Many are asking sellers to contribute to closing costs—and due to recent legal changes, 99% of buyers are requesting sellers cover the buyer’s agent commission. On top of that, buyers are more aggressive with repair requests and are willing to walk away if they feel the seller isn’t being reasonable. Remember, most buyers are tight on cash, and they prioritize financing costs over upfront expenses.

Rental Market Snapshot (March 2025)

- Median Lease Rate: $2,195 (up from $2,100 in March 2024)

- Average Living Area: 1,822 sq ft (down from 1,841 sq ft)

- Days on Market: 26 days (compared to 27 days in March 2024)

Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com

3007 W Horizon Ridge Pkwy, Ste. 210, Henderson, NV 89052

Categories

Recent Posts