Navigating Homebuying with Current Mortgage Rates: Affordable Strategies

Navigating Homebuying with Current Mortgage Rates

Many prospective homeowners are on standby, hoping for mortgage rates to dip before making a purchase. However, current forecasts suggest a minor reduction at best, which might not meet everyone's expectations.

The silver lining? There are still viable paths to affordable homeownership, even without a significant drop in rates.

Future of Mortgage Rates

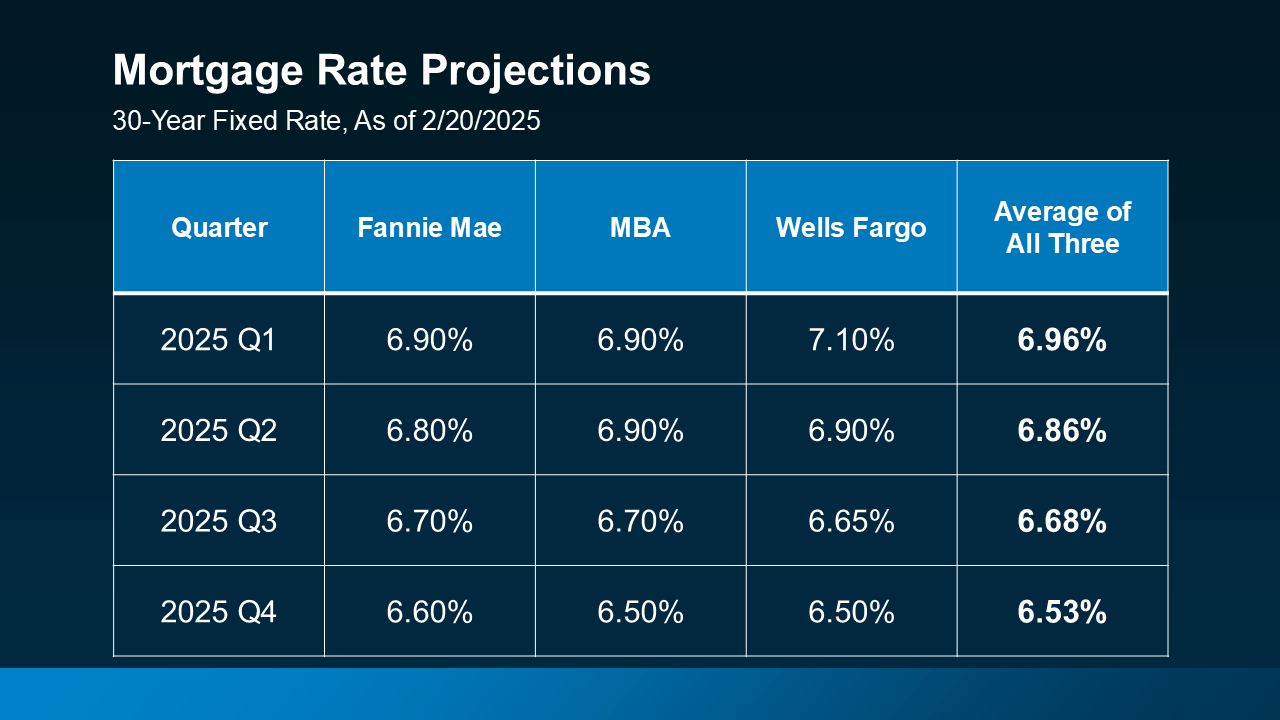

Recent trends indicated a possible decline in mortgage rates below 6% by year's end. However, updated forecasts from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo now anticipate rates will hover between 6.5% to 7%. This adjustment suggests that waiting for drastically lower rates could be futile, especially if life events—like a new job, a growing family, or marriage—necessitate an earlier move.

Creative Financing Solutions

With less dramatic rate drops on the horizon, exploring alternative financing methods could be your ticket to homeownership sooner rather than later. Here are three innovative strategies worth discussing with your lender:

Mortgage Buydowns

Buydowns involve paying an upfront fee to reduce your mortgage rate temporarily. This option is gaining traction, particularly among first-time buyers, with 27% of agents reporting an increase in buyers seeking seller-assisted buydowns for immediate relief.

Adjustable-Rate Mortgages (ARMs)

ARMs offer lower initial rates compared to traditional 30-year fixed mortgages, making them appealing for those who plan on refinancing or expect rates to fall. Lance Lambert, Co-Founder of ResiClub, clarifies today's ARMs are more secure than those before the 2008 financial crisis.

He explains, "Unlike the mid-2000s, borrowers now must qualify based on their ability to afford a higher prospective payment, ensuring a more stable lending environment."

Assumable Mortgages

This option allows you to take over the seller’s existing mortgage, often at a more favorable rate. With over 11 million homes eligible for assumable mortgages, it's a pathway worth considering for better terms.

Waiting out the market for significant rate decreases may not be the most strategic approach. Instead, leveraging options like buydowns, ARMs, or assumable mortgages could facilitate more immediate and affordable homeownership. Discuss with a local lender to determine the best strategy for your circumstances.

How will these insights shape your homebuying decisions this year? Let us know today:

Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com

3007 W Horizon Ridge Pkwy, Ste. 210, Henderson, NV 89052

Categories

Recent Posts