Can You Buy a Home With Student Loans? | Truth & Data

Can You Buy a Home with Student Loans? Here's the Truth (and the Data)

📝 Quick Facts Inside This Post:

- 72% of people with student loans think it delays homeownership.

- You can still qualify for a mortgage with student debt.

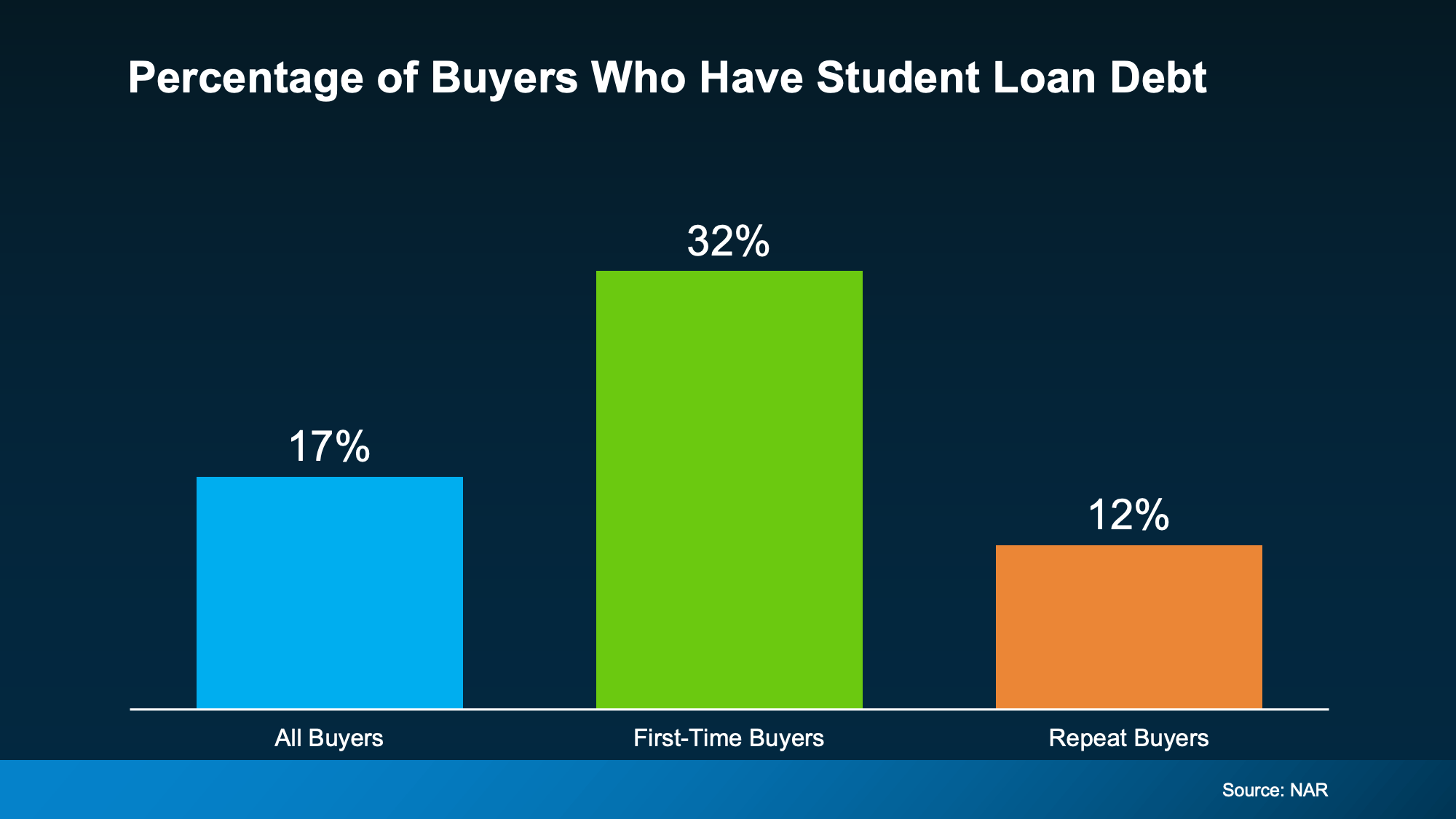

- 32% of first-time homebuyers had student loans and still bought a home (NAR).

- Lenders care more about your debt-to-income ratio and credit health than the loan type.

- Median student loan balance among buyers: $30,000

Jump Ahead: Can I Qualify? | See the Data | What Lenders Look For | Don’t Delay

Student loans do not automatically disqualify you from buying a home. According to a recent survey, 72% of borrowers believe student debt is holding them back from homeownership. But here's the kicker: it might not be the debt—it might be the misconception.

Let’s get real about what’s possible, and what’s just myth.

Can You Qualify for a Home Loan if You Have Student Loans?

If you’ve ever asked yourself:

- “Do I have to wait until my student loans are paid off to buy a house?”

- “Can I even qualify for a mortgage with this debt?”

You’re not alone. But here’s the reality: you might be more mortgage-ready than you think.

Yahoo Finance puts it plainly:

"Student loans don’t have to get in your way when it comes to becoming a homeowner. With the right approach and an understanding of how debt impacts your home-buying options, buying a house when you have student loans is possible."

The Data Doesn’t Lie: People Are Buying Homes With Student Debt

Let’s look at the numbers.

According to the National Association of Realtors (NAR):

- 32% of first-time buyers had student loan debt.

- Even among all buyers, 17% were managing student loans.

- And 12% of repeat buyers still carried that balance.

So no, student loans don’t put you in a special category of "not-ready-to-buy." In fact, you’re in good company.

Here’s What Actually Matters to a Lender

It's not the type of debt—it’s how you manage it. As Chase explains:

“Student loans usually don’t affect your ability to qualify for a mortgage any differently than other types of debt you have on your credit report, such as credit card debt and auto loans.”

If your income is stable, your credit score is decent, and your debt-to-income ratio is within reason—you could be closer to homeownership than you realize.

For context: the median student loan balance among first-time buyers is $30,000. And they’re still making it happen.

Don’t Delay Your Dream Just Because of a Balance

Here's the deal:

✅ You don’t have to wait until your loans are gone

✅ You don’t need a perfect financial profile

✅ You just need the right strategy—and the right lender

Before you write yourself off or delay your search another year, let’s talk. A quick conversation with a lender can give you a snapshot of your buying power—and maybe a green light to move forward.

Because your student loans don’t have to define your future.

Related Reading:

- Roadmap to Homeownership

- Spring Market Buyer Advice: How to Stand Out in a Competitive Market

- Quarterly Housing Market Update

Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com

3007 W Horizon Ridge Pkwy, Ste. 210, Henderson, NV 89052

Categories

Recent Posts