Is Renting Costing You More Than You Think?

Renting Feels Safer, But Is It Actually Costing You More?

🔗 Jump To Section

You’ve probably asked yourself recently: “Should I even try to buy a home right now?”

Totally fair question. Between elevated home prices and mortgage rates, renting can feel like the logical (or only) option. Sometimes it is. You should only buy when you’re ready and it makes sense for your finances and lifestyle.

But here’s the reality, renting may feel easier now but it could be sabotaging your financial future.

According to Bank of America, 70% of would-be buyers are already worried about how long-term renting might delay or derail their goals. They’re not wrong. Renting comes with trade-offs—and one of the biggest is lost wealth-building potential.

How Homeownership Builds Real Wealth

Buying a home isn’t just a lifestyle move, it’s a financial strategy. Here's why:

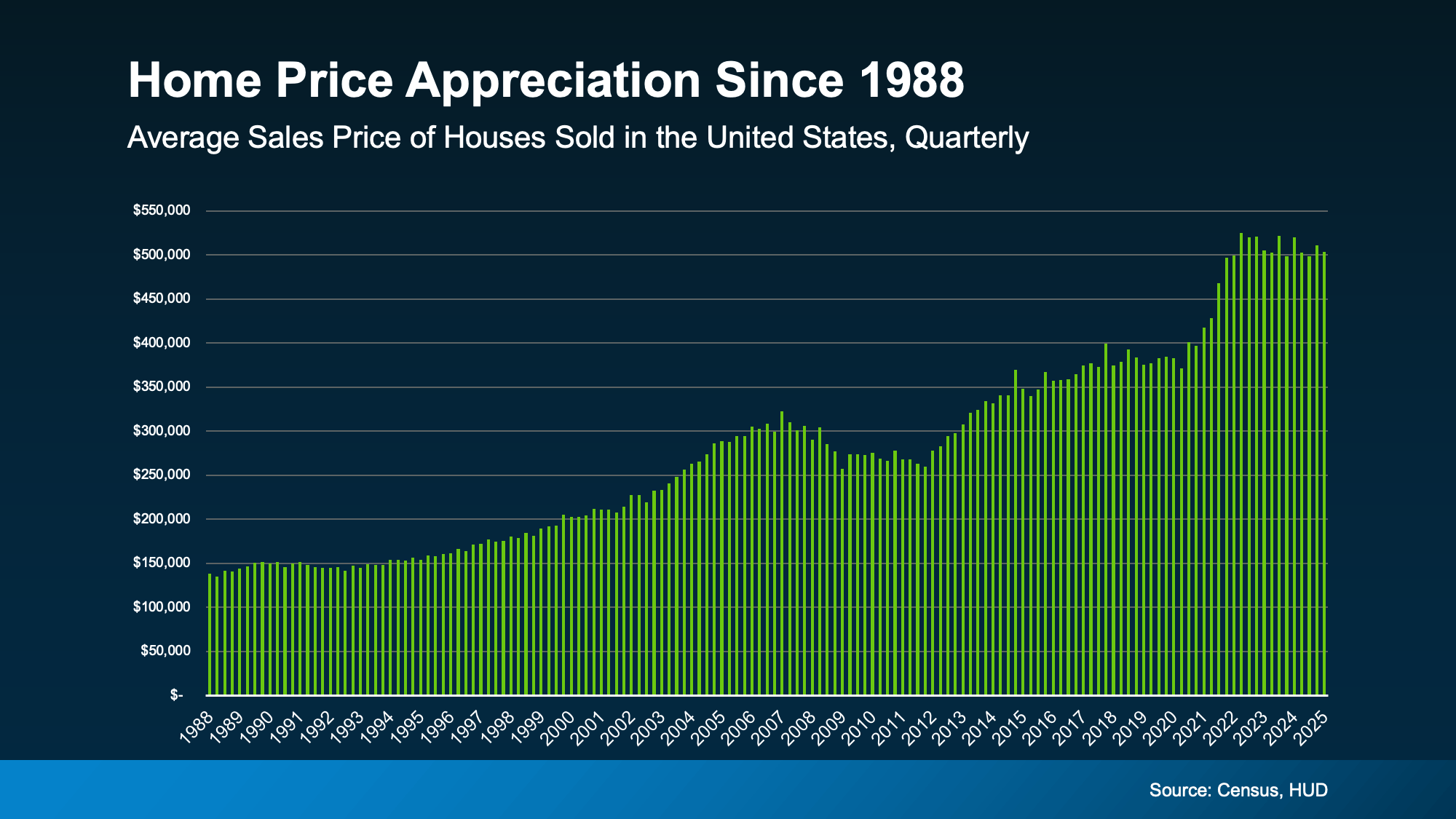

- Home values tend to rise over time (see graph below)

- Equity builds with every mortgage payment

- That equity becomes part of your net worth

And this isn’t some niche advantage. It’s massive.

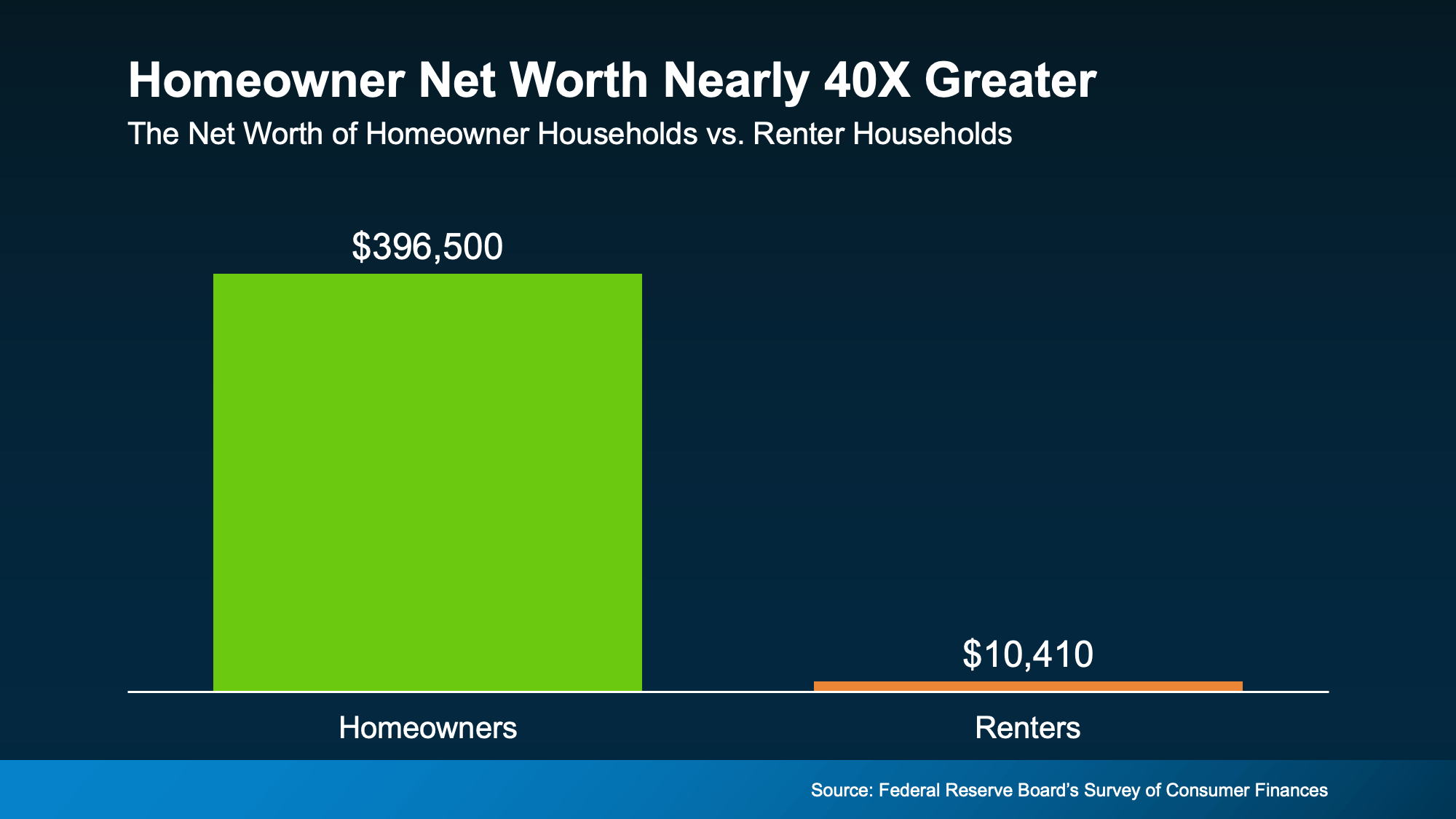

The Federal Reserve reports the average homeowner’s net worth is nearly 40x that of a renter. See graph below.

Homeownership is the single biggest wealth builder for most Americans. And delaying that purchase—while understandable—often just makes it harder (and more expensive) to enter the market later.

You're Paying a Mortgage Either Way

Let’s be blunt:

- Renting = paying your landlord’s mortgage

- Owning = paying your own

And only one of those payments comes back to benefit you.

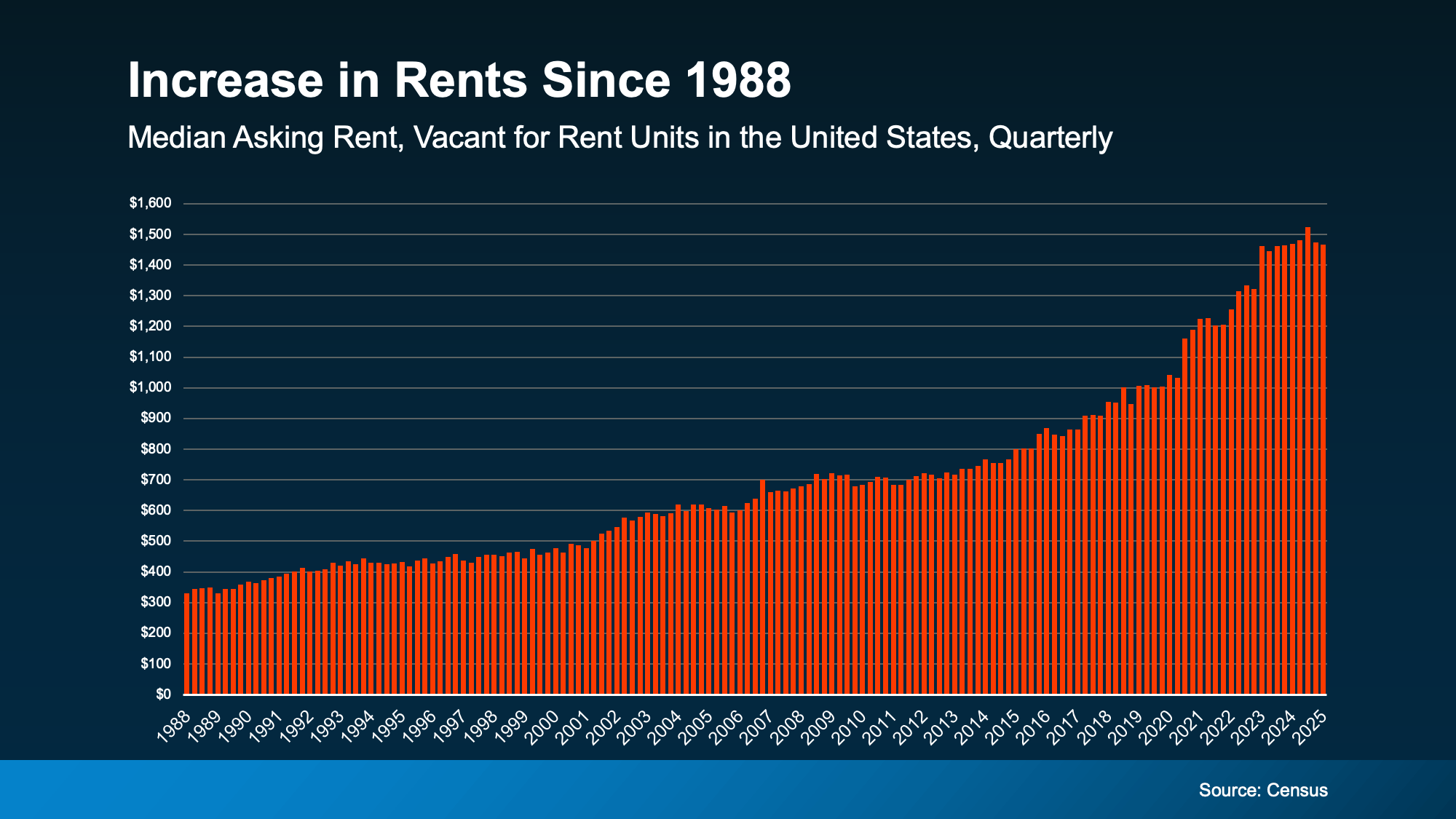

Sure, renting might feel flexible, less expensive, and lower stress right now. But over time? Rents rise, and you build zero equity. Plus, saving while renting can be brutal—especially when rent increases keep eating into what could be your down payment fund.

Even Realtor.com economist Joel Berner says:

“Households working on their budget will find it much easier to continue to rent than to go through the expenses of homeownership. However, they need to consider the equity and generational wealth they can build up by owning a home that they can’t by renting it. In the long run, buying a home may be a better investment even if the short-run costs seem prohibitive.”

Rent or Buy? Here’s What Really Matters

Here’s the bottom line: Renting might be cheaper today. But buying is what helps you win the long game.

If you’re feeling stuck or unsure about timing, that’s okay. It’s normal. What matters most is having a plan—and a real estate partner who helps you stick to it. This isn’t about buying now if you’re not ready. It’s about not waiting forever without a strategy.

Your Exit Plan from Renting

If homeownership feels out of reach right now, you’re not alone. But there’s a path forward.

We can:

- Assess your financial readiness

- Set smart, achievable homeownership goals

- Connect you with a trusted local lender

- Create a timeline that makes sense for your life and budget

📞 Let’s talk about your plan to own—not just rent forever. Call 702-930-9551 today.

Want to keep learning?

Check out our post on How Student Loans Impact Buying a Home and Facts About Our Current Housing Market

Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com

3007 W Horizon Ridge Pkwy, Ste. 210, Henderson, NV 89052

Categories

Recent Posts