The Latest Trends in the National Housing Market

Understanding the Latest National Trends in Housing: What You Need to Know If you're in the market to buy or sell a home, staying informed about the latest national housing trends is crucial. Let's dive into what's currently happening in the real estate in the United States. More Homes Are Coming

Why Experts Upped Their 2024 Home Price Forecasts

In recent months, the conversation around home prices for 2024 has taken a turn, according to the latest insights and market trends. Experts, with a new dose of optimism, are adjusting their forecasts upwards, signaling a bullish outlook for the real estate market. Let's dive into how the perspect

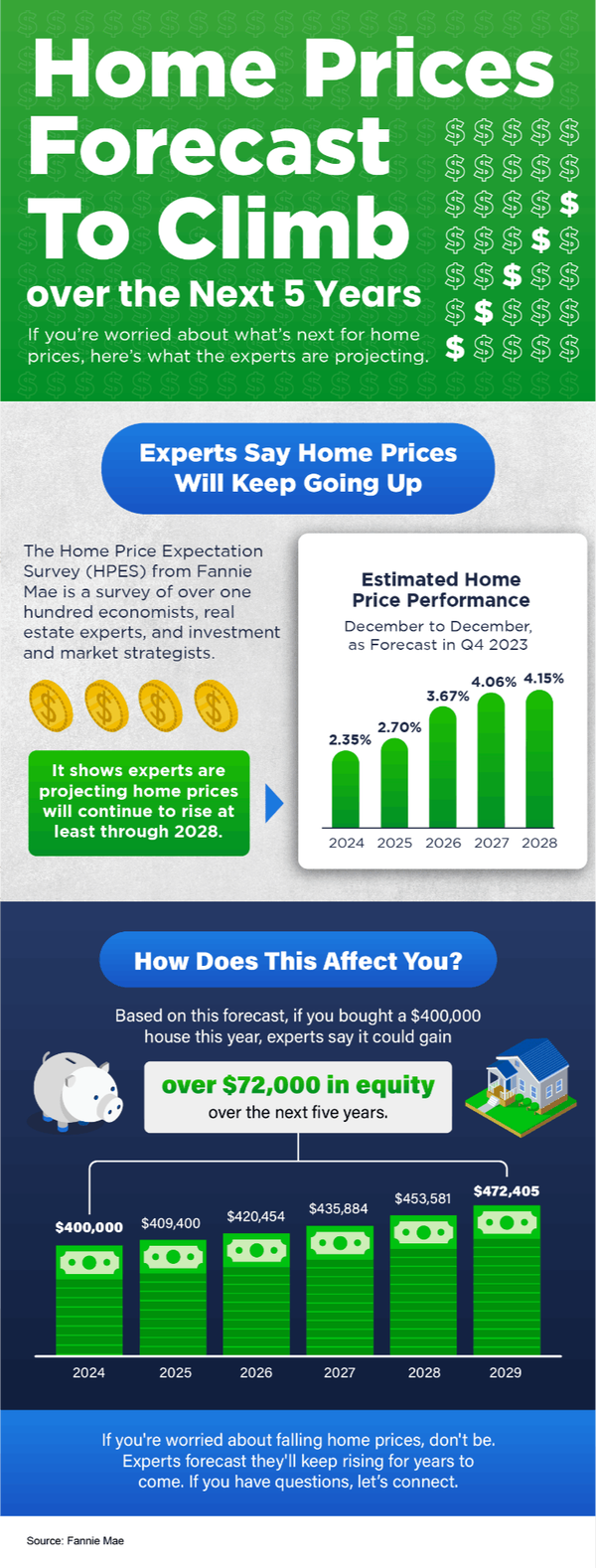

Home Prices Forecast To Climb over the Next 5 Years

If you’re worried about what’s next for home prices, know the HPES shows experts are projecting they’ll continue to rise at least through 2028. Based on that forecast, if you bought a $400,000 house this year, experts say it could gain over $72,000 in equity over the next five years. If you're wor

Categories

Recent Posts