Winning the Bidding War: 4 Tips to Make Your Best Offer on a Home

Springtime is the hottest season for real estate! To increase your chances of securing the home you want, keep these four tips in mind. 1. Rely on a real estate professional to support your goals. Bankrate notes: “...select the best real estate agent for your needs. They will be a critical part of your home buying process.” They have in-depth knowledge of the local market, which can help you cater to the seller's needs and make your offer stand out. 2) It's crucial to understand your budget. Sandy Higgins, Senior Wealth Advisor at Capstone Financial Advisors, puts it: “Understand your current budget ... what are your expenses, how’s your spending, would you need to make changes?” Working with a lender to get pre-approved for a loan shows sellers you're serious and financially confident, giving you a competitive edge. 3) Take the time to think everything through before making an offer. According to Danielle Hale, Chief Economist at realtor.com: “In general, you likely have more time to make an offer, although that’s certainly not a guarantee. If you’re on the fence about a home or its asking price doesn’t quite fit your budget, you might want to keep an eye on it, and if it doesn’t sell right away, you may have some room to negotiate with the seller.” While the market is still competitive, it's moving at a slower pace than during the pandemic, allowing you more flexibility to explore options and receive guidance from your agent. 4) Work with your advisor to negotiate. Unlike during the pandemic, today's market allows for more negotiating power, making it important to consider potential concessions or inspections with the guidance of a trusted real estate advisor. In summary, if you're buying a home this spring, connect with a professional for guidance to make your best offer. Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com Instagram | Facebook | YouTube | LinkedIn | TikTok 980 American Pacific Dr. Ste. 111 Henderson, NV 89014

Should You Buy a Brand New Home?

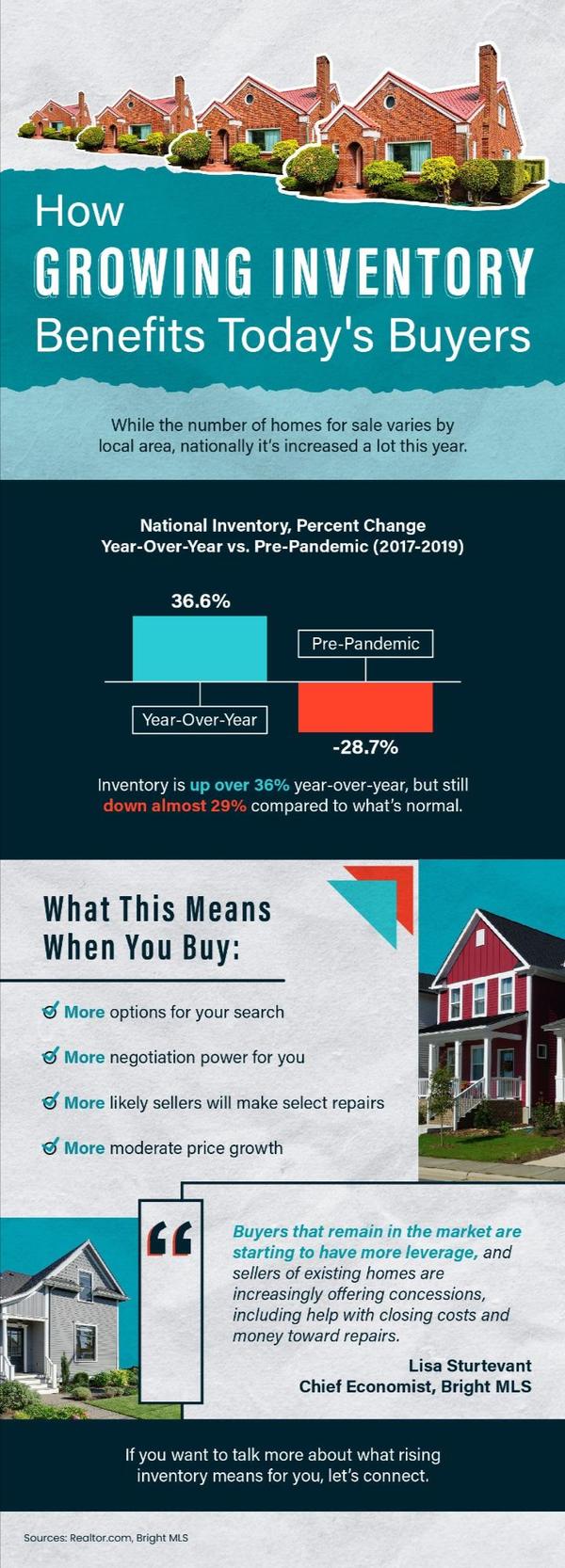

If you're in the market for a new home, you might be thinking about buying a pre-owned one. However, with the limited number of houses available for sale right now, it's a good idea to consider all your options, including newly built homes. The Number of Newly Built Homes Is on the Rise Over the past 14 years, there hasn't been enough new home construction to keep up with demand, which has resulted in historically low inventory levels. But the good news is that the number of newly built homes is on the rise, as shown in the graph below: As Mark Fleming, Chief Economist at First American, shares, that’s good news for buyers: “While existing-home inventory remains limited, the silver lining for home buyers is that new-home inventory is on the rise, and a new home at the right price is a pretty good substitute.” Builder Incentives Can Provide a Boost While there are more newly constructed homes for sale, builders are slowing down the pace of building until they sell more of their current inventory. According to Logan Mohtashami, Lead Analyst at HousingWire: “The builders have to work off the backlog of homes, but instead of 3%-4% mortgage rates, they’re dealing with 6% plus mortgage rates, which means they have to provide many incentives to make sure those homes sell.” However, many builders are offering incentives to entice buyers. Fleming also explains: “The National Association of Home Builders reported that nearly two-thirds of builders were offering incentives, including mortgage rate buydowns, paying points for buyers and price reductions, which could entice potential home buyers.” A builder who’s willing to pay to reduce your mortgage rate could be a game changer. Ksenia Potapov, Economist at First American, puts it this way: “A one percentage-point decline in mortgage rates has the same impact on affordability as an 11 percent decline in house prices.” So, Should You Buy a Brand New Home? To decide whether to buy a newly built home or a pre-owned one, it's best to work with a trusted real estate professional who knows the local market and can help you weigh the pros and cons of each option. So, even though there aren't a lot of homes for sale right now, there are more newly built homes available than in the past, and many builders are offering incentives. Contact us, and we can help you determine if a new home is the right choice for you. Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com Instagram | Facebook | YouTube | LinkedIn | TikTok 980 American Pacific Dr. Ste. 111 Henderson, NV 89014

What To Know About Closing Costs

Before buying a home, it's important to prepare for the associated expenses. While many homebuyers focus on saving for the down payment, they may be caught off guard by the closing costs they have to pay. To avoid any surprises, it's crucial to understand what closing costs are and how much you should budget for. What are closing costs? According to Bankrate: “Closing costs are the fees and expenses you must pay before becoming the legal owner of a house, condo or townhome . . . Closing costs vary depending on the purchase price of the home and how it’s being financed . . .” Closing costs refer to the fees and expenses involved in the transaction of purchasing a home. These costs can vary based on the location, purchase price, and financing method, but typically include government recording costs, appraisal fees, credit report fees, lender origination fees, title services, tax service fees, survey fees, attorney fees, and underwriting fees. According to Freddie Mac, closing costs are usually between 2% and 5% of the total purchase price of the home. How much do you need to budget for closing costs? For example, if you are planning to purchase a home for the median price of $366,900, your estimated closing costs could range from $7,500 to $18,500. It's important to note that the actual closing costs will be higher or lower based on the purchase price. What's the best way to make sure you're prepared at closing time? Freddie Mac provides great advice for homebuyers, saying: “As you start your homebuying journey, take the time to get a sense of all costs involved – from your down payment to closing costs.” To ensure you are prepared for closing, take the time to get a sense of all the costs involved, from the down payment to closing costs. Work with a team of trusted real estate professionals to understand the exact amount you'll need to budget for. Your real estate agent can connect you with a lender, and together, your expert team can answer any questions you might have. In conclusion, it's vital to plan ahead for the fees and expenses you'll be responsible for at closing. To ensure you feel confident throughout the process, work with a team of professionals and plan ahead for the costs involved. Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com Instagram | Facebook | YouTube | LinkedIn | TikTok 980 American Pacific Dr. Ste. 111 Henderson, NV 89014

Categories

Recent Posts