Fed Cut Rate Impact on Mortgage Rates

How the Federal Reserve’s Next Move Could Impact the Housing Market

Now that it’s September, all eyes are on the Federal Reserve (the Fed). The overwhelming expectation is that they’ll cut the Federal Funds Rate at their upcoming meeting, driven primarily by recent signs that inflation is cooling, and the job market is slowing down. Mark Zandi, Chief Economist at Moody’s Analytics, said:

“They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

But what does this mean for the housing market, and more importantly, for you as a potential homebuyer or seller?

Why a Federal Funds Rate Cut Matters

The Federal Funds Rate is one of the key factors that influences mortgage rates – things like the economy, geopolitical uncertainty, and more also have an impact.

When the Fed cuts the Federal Funds Rate, it signals what’s happening in the broader economy, and mortgage rates tend to respond. While a single rate cut might not lead to a dramatic drop in mortgage rates, it could contribute to the gradual decline that’s already happening.

As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), points out:

“Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

And any upcoming Federal Funds Rate cut likely won’t be a one-time event. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.”

The Projected Impact on Mortgage Rates

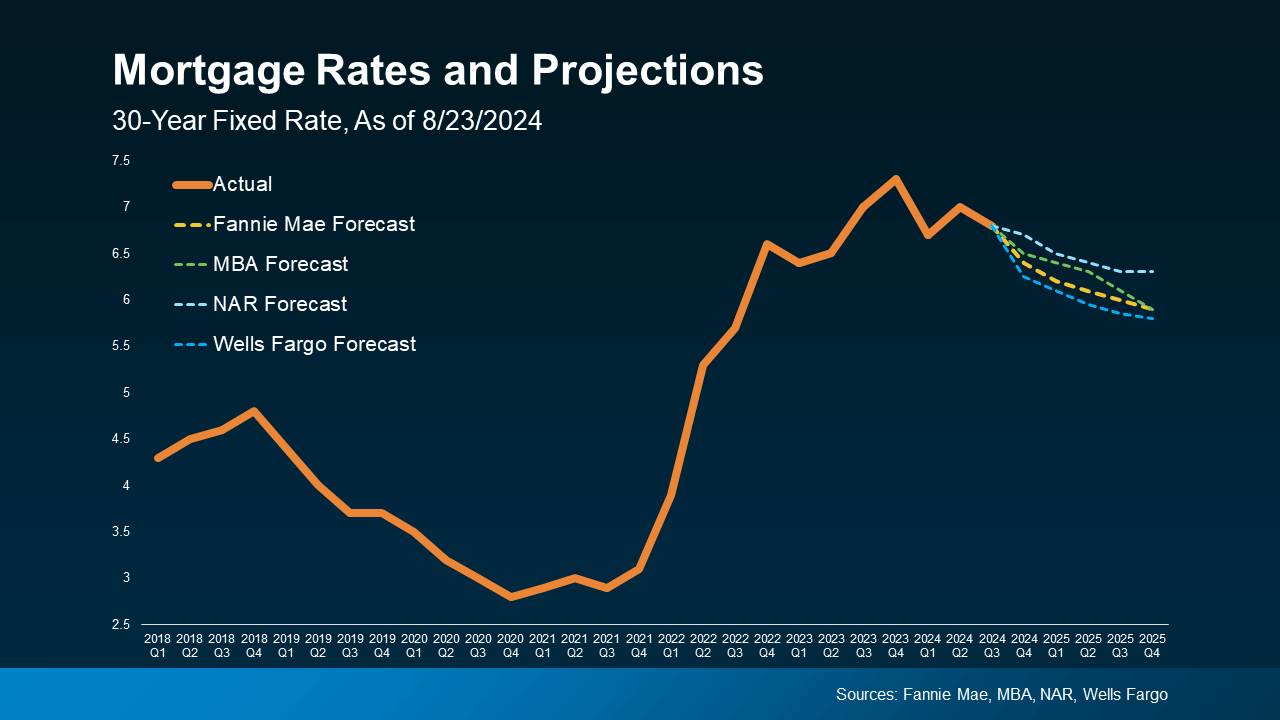

Here’s what experts in the industry project for mortgage rates through 2025. One contributing factor to this ongoing gradual decline is the anticipated cuts from the Fed. The graph below shows the latest forecasts from Fannie Mae, MBA, NAR, and Wells Fargo (see graph below):

These experts all anticipate that mortgage rates will continue to gradually decline through 2025 due to the Fed’s expected cuts. This slow decline is good news for both buyers and sellers for a couple of reasons:

- Easing the Lock-In Effect: Lower mortgage rates might help homeowners who have been reluctant to sell due to the lock-in effect—where homeowners avoid selling to keep their low-rate mortgages. A slight drop in rates could make selling more appealing, although it’s unlikely to cause a surge in market listings since many may prefer to hold onto their low rates.

- Encouraging Buyer Activity: For prospective buyers, any decrease in mortgage rates could make entering the market more attractive. Lower rates mean lower monthly mortgage payments, potentially making homeownership more accessible.

What’s Your Best Move?

While the expected Federal Funds Rate cut won’t drastically alter mortgage rates overnight, it contributes to a broader trend of more manageable rates. Jacob Channel, Senior Economist at LendingTree, offers a piece of advice:

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

Conclusion

The likely Federal Funds Rate cut, spurred by improvements in inflation and a slowdown in job growth, should have a beneficial albeit gradual effect on mortgage rates. This easing of rates could open up new opportunities for you in the housing market. When you’re ready to explore these possibilities, let’s connect so you can make the most informed decision when the timing is right for you.

Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com

3007 W Horizon Ridge Pkwy, Ste. 210, Henderson, NV 89052

Categories

Recent Posts