Las Vegas & Henderson Housing Market Update | Quarter 3, 2024

Las Vegas & Henderson Housing Market Update | Quarter 3, 2024 | Graham Team Real Estate

Two Things Can Be True at Once!

Could October’s rise in mortgage rates both hurt and help the housing market, and how is the increase actually a positive? Believe it or not, keeping mortgage rates in the 6-7% range even after the Federal Reserve cuts is actually a positive?

This is because mortgage rates are driven by the bond market. If you meet with any financial advisor, they will advise keeping your 401K, IRA or investment account balanced between stocks and bonds. When times are good, you aim for account growth, so you increase the percentage of your funds in stocks. During uncertain times or at a stage in life where you prefer less risk, you shift your investment towards bonds. Right now, the market, investors and businesses are feeling more secure, and are purchasing more in the stock market rather than in bonds. Less buyers of bonds means the rates must go up to attract more purchases.

Historically, mortgage rates have fallen below the 10-year treasury yield, which generally tracks where mortgages rates are heading. Per the graph below, you can see the correlation over the last year between the 10-year treasury yield and national mortgage rates.

September’s dip in mortgage rates was closely related to international uncertainty in the market rather than the Federal Reserve rate drop, as rates had already adjusted for the anticipated Fed Rate cut back in July and August.

The market was certainly expecting the Fed to cut rates, if rates hadn’t been cut then it would have been perceived by the bond market as unstable conditions, resulting in the mortgage market immediately responding upwards.

When the economy is working on a positive outlook, increased expansion and job growth occurs, which is backed up by higher than expected job and wage reports that were recently released. So in conclusion, the increase in mortgage rates is in fact a positive sign for housing, as people buy homes when they feel more certain about the future and the economy.

The opposite is also true, because the increase in mortgage rates in turn hurts the housing market. With Nevada being a swing state in the election, you can barely turn on the radio, TV, a podcast or social media without being bombarded about the US housing market crisis. Home affordability is in a critical state. With mortgage rates remaining in the 6-7% range and house prices rising year-over-year, many families simply cannot afford to purchase a home.

The number of Southern Nevadans who can afford the median home price of $479,900 in Las Vegas is less than 33% of households. There is currently a 15% deficit between median income and median home price. A reduced number of homebuyers affects the home market with either increased lengths of time to sell, or eventually median home prices if incomes do not rise to match.

Other factors that affect the real estate market in Southern Nevada:

- Cash Buyers or Retired Buyers: Although the number of cash buyers purchasing homes in 2024 has declined from previous years, there’s still a significant number who are unlimited by income and affecting home prices. Cash buyers increased over the last year, and by September 2024 we had already exceeded the total number of cash buyers for all of 2023.

- Limited Inventory: House prices are affected by supply and demand. Although inventory is rising slightly, it’sstill at record lows. Sellers are reluctant to let go of very low mortgage rates and are therefore holding onto their homes longer than they have previously. As buyer activity is limited by affordability, low inventory has kept home prices stable. With a slight uptick in inventory, and life events eventually requiring people to move, prices have remained steady but the days-on-market (DOM) have increased. Homes are taking longer to sell than in previous years.

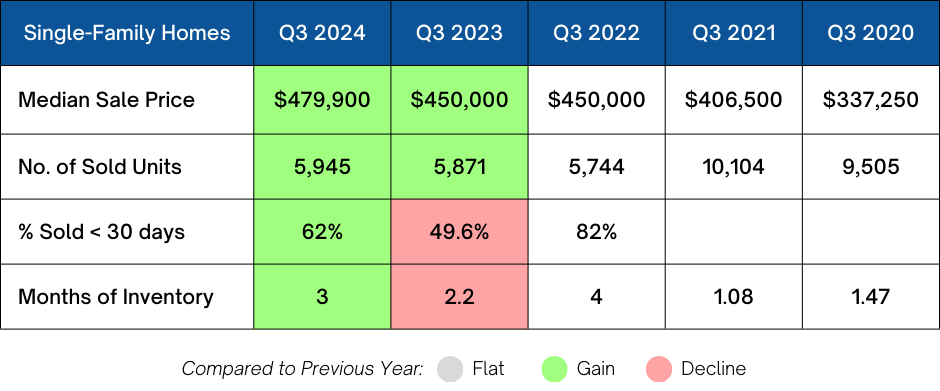

The key matrix for the Southern Nevada housing market over the 3rd quarter of 2024

- Median Home Price: $479,000 ⬆ YOY* 6.6% | 1% up from 2nd Qtr

- # of Homes Sold (3rd Qrt): 6,833 ⬆ YOY (1%) | down 6.6% from 2nd Qrt

- Inventory (3rd Qrt): ⬆ YOY 36% | over 50% up from 2nd Qtr

- Mortgage Rate: ⬇ YOY (1.18%) on rate | .25% down from 2nd Qtr

*YOY = year-over-year

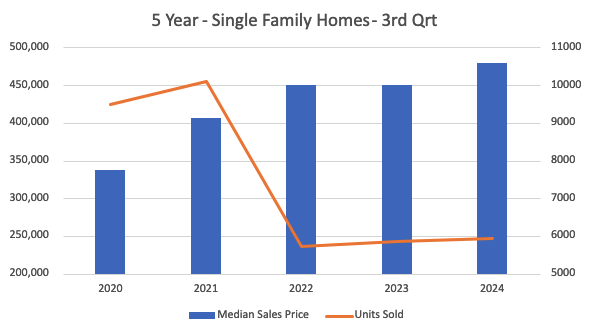

Five Year Look at the Housing Market

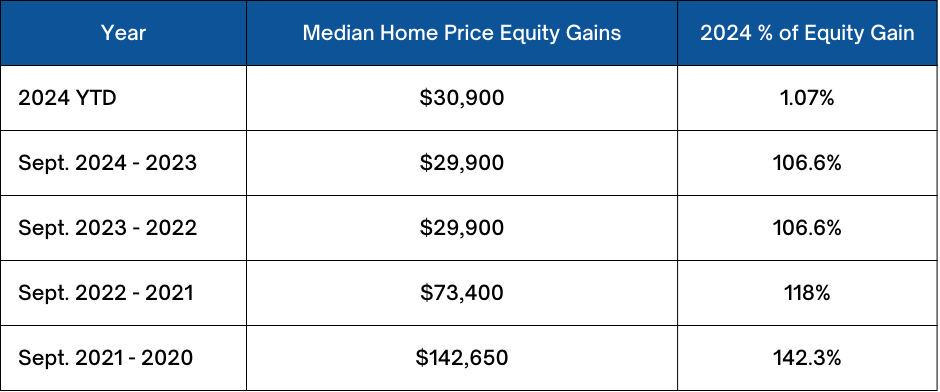

Seeing all green in the 3rd quarter column is not a good thing– the increase in months of inventory means it will take longer for the average home to sell. The real positive for homeowners is the percentage of equity gained in the last five years, based on the median sales price equity gain of $142,650:

Core Factors – Housing Market

Mortgage Rates:

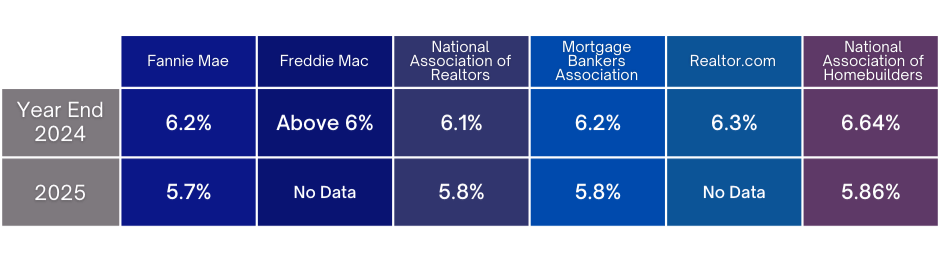

On October 8th, Business Insider reported the following projections from leading mortgage experts. However, these projections were most likely made prior to the surprising job reports published in October and personally feel a little too aggressive on the projected rate cuts. We expect rates to stay relatively flat through November, and if the economy continues to stay robust, we may not see lower rates until later in 2025.

Affordability:

The housing crisis that is cited on every political ad is really an affordability crisis. Median home prices combined with current mortgage rates are out of reach for the majority of US households, which will be an ongoing concern for the rest of 2024 and 2025. We have seen an increasing trend for new construction building less upper-end homes and focusing more on entry-level priced houses. Over the past few months alone, we have helped numerous clients to secure a new home for below market interest rates, allowing them to step into homeownership for the first time.

National Law Change in Buyer’s Representation Commission Update:

Effective August 1st in our Las Vegas Realtor Association, seller consideration for buyer’s representation commission is no longer offered. Previously, the compensation was set and paid by the seller, so this was a significant change for buyers as they will now set the amount their agent is paid to represent them. Over the last 45 days, we have seen buyer’s offers that e ask sellers to cover the amount they negotiated with their buyer’s agent. This is because it’s an out-of-pocket expense to buyers, and as of right now they cannot roll it into their mortgage. Most buyers need the cash they have for down payment, and simply cannot go ahead with a purchase without the seller’s assistance on closing costs. However it’s not just buyers with loans, every cash offer we’ve received since August 1st asked for the seller’s contribution towards the buyer’s closing costs.

Rental Market

The median rent for a single-family home remained steady over the thirdquarter,with the median lease rate now standing at $2,190 for a +/- 1,807 sf home. The median price-per-square foot is $1.22, with new homes or updated homes still obtaining a premium. Days-on-market jumped from 18 days to 26 days.

We were recently asked the following question by a potential renter: “You cannot still be requiring 3x the monthly rent for income? There is no way the average person can do that.”

Quick Housing Snapshot

Housing snapshot of 2nd Quarter, 2024:

Our Takeaway

What is expected for the rest of 2024?

- Sales Prices: Flat; We may see weeks where prices fluctuate up and down slightly.

- Interest Rates: Remaining in the mid 6% range for most of the final quarter. .

- Foreclosures: Very slight increase due to the amount of credit card and student loan debt.

- Inventory: Hovering around 3 months.

- Rental Rates to Flatten: Maintaining the median price of $1.15 to $1.20.

Buyer Opportunities

- Moderate Selection: Inventory will continue to rise slightly, giving buyers more options.

- Be Prepared: If we had a dollar for every prospective Buyer who said that they’re waiting until after the election to buy because they “think prices are going to drop”, we would be rich. But historically facts dispute this notion_ because as our most recent blog covers, over the last 50 years election years have had no effect on home prices.

- +/- Out-of-Pocket Expenses

- a. Very few over-appraisals value offers.

- b. Sellers are willing to contribute to the buyer’s closing costs & buyer’s agent representation commission.

- c. Sellers are willing to accept offers with loan programs for down payment assistance. We have closed several homes with these programs so far this year.

- Neutral Terms

- a. Repair requests will be more evenly considered now.

- b. Buyers can really think about the homes they tour and decide on the best one for them, with no pressure to make a same-day decision.

- c. Competing with less multiple offers.

- d. Longer close of escrow (COE) periods. If you are on a lease and need time to coordinate the end of your lease term closer to the COE, we have successfully negotiated longer dates which reduces costs and gives you more time, relieving stress.

- Affordability: Never buy more home than you can afford –e don’t want our clients to be house poor. Financial Advisors and Mortgage lenders recommend the range of 25-35% of your gross monthly income be put towards your home mortgage payment (Principle, Interest, Tax, Insurance = PITI). For those who have the income to qualify, and providing it fits their family’s budget, buying ahead of the wave of buyers may offer the best deal. Many of our lender partners offer their clients a one-time rate adjustment within 3-to-5 years, which can give you an advantage at today’s home prices and then a reset when mortgage rates drop. Never speculate about rates dropping however; only purchase a home that fits your budget.

- New Home Option: New homes continue to provide the best interest rates as builders are still offering incentives. We expect this will slow down and incentives will drop off first, followed by mortgage rate discounts. Mortgage rate discounts offered today range between 5-6%, with a 5-10% down payment and less incentives being offered inthe most desirable new home communities We can provide a weekly update of the incentives being offered by each builder.

- Renting Will Still Be Expensive

- a. If you rent a home for $2,200 for 3 years, you just paid your landlord $79,200 with no equity, no gain.

Be willing to compromise: Think about purchasing a smaller home than the one you’re renting, to stay within budget.Think of it as a stepping stone to reach your ultimate home. Every year you are investing $24,000 in your future self towards your ultimate home goal.

Seller Opportunities

Price-to-market value: The market moved slightly from a seller’s market to a neutral market, andsellers who overpriced their homes sat on the market. When a home sits on the market, you lose buyer appeal and in most cases the eventual achieved price will be lower than if it was priced to market in the first place. There’s no need to price under market, but if you price correctly, you can expect several offers to choose from. You’ll also be able to identify the best buyer on price, terms, and qualifications. We expect buyer activity to stay flat through the 3rd quarter. Our Advice:

- Review the market comparably and be realistic with your home’s current value.

- Marketing your home will be extremely important, andhaving a high-quality online presence is crucial.

- Have patience: It will take longer to sell. 61% of homes sold in 30 days; we expect to see that number drop in the 4th quarter.

- Buyer terms: Expect home buyers to ask for closing cost credits, contributions toward their agent commission, and reasonable repairs.

- We are seeing a lot more seller-occupied homes on the market. Have a showing schedule that accommodates the most amount of buyer traffic, resulting in more and better offers.

- Post Occupancy for our sellers: We can negotiate terms that allow the seller to remain in the home for up to 60 days (sometimes longer, depending on the buyer’s mortgage), which allows our sellers to make stronger offers on their home purchases. It also takes the stress out of worrying about a contingency deadline on their new home.

Questions about this report? Contact us below:

Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com

3007 W Horizon Ridge Pkwy, Ste. 210, Henderson, NV 89052

Categories

Recent Posts