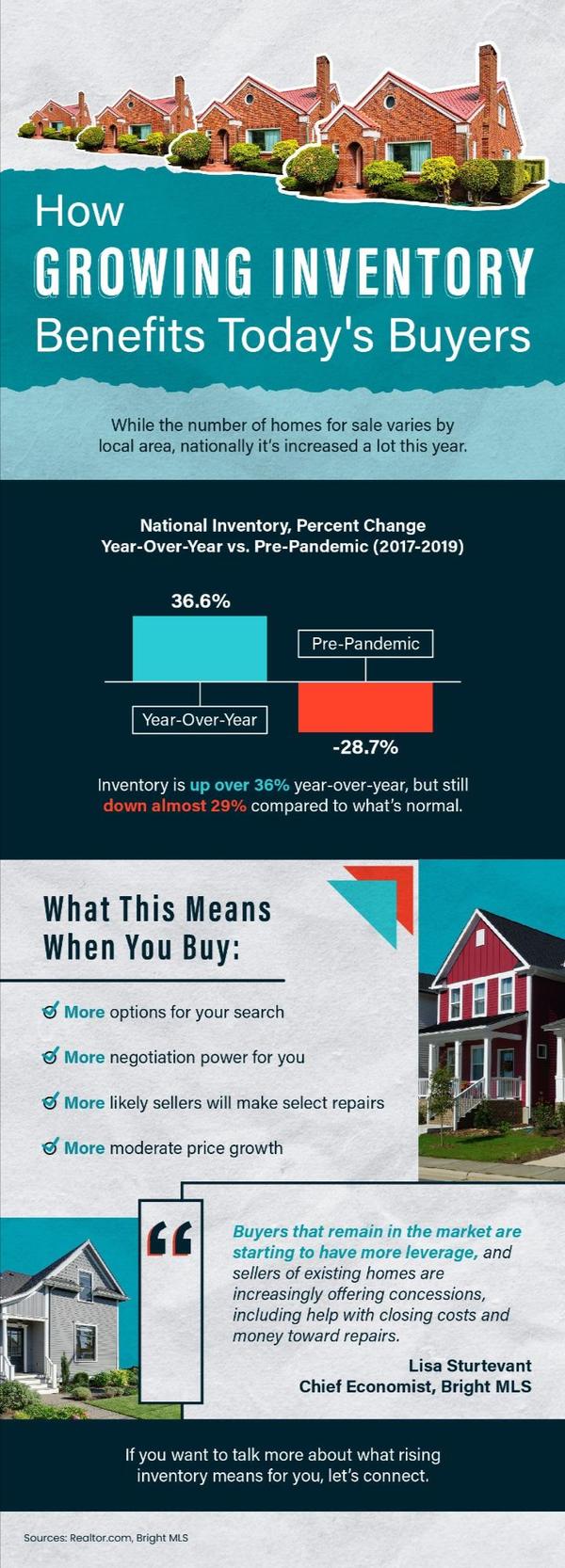

How Growing Inventory Benefit's Today's Buyers

Growing Housing Inventory in Today's Market The dynamics of the housing market can differ significantly from one local area to another. While the national inventory of homes for sale has seen an increase of over 36% compared to last year, it remains nearly 29% below the levels that are typically expected. Specifically in the Las Vegas Valley, the market has experienced a notable surge, with the inventory of single-family homes up by 31.5% year-over-year. This shift in inventory dynamics brings several implications for potential homebuyers. Firstly, there are now more properties to choose from, which broadens your options during your home search. Additionally, the increased inventory provides more room for negotiation, giving buyers like you greater leverage in deal-making. This can often lead to sellers being more willing to make necessary repairs and concessions during negotiations. Moreover, with more homes available, the intense price growth that has characterized recent years is beginning to moderate, leading to more stable and sustainable price increases. This substantial increase not only highlights the growing opportunities for buyers in this area but also underscores the potential for more favorable deal terms and conditions. If you’re curious about how these developments in rising inventory might specifically affect your buying opportunities, or if you’re considering entering the market soon, we encourage you to get in touch. Let’s discuss how you can leverage these conditions to your advantage and possibly find the home that meets your needs and budget. Connecting with knowledgeable real estate professionals can help you navigate this evolving market landscape effectively! Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com 3007 W Horizon Ridge Pkwy, Ste. 210, Henderson, NV 89052

Summer 2024 Housing Market Report: Key Stats for Southern Nevada

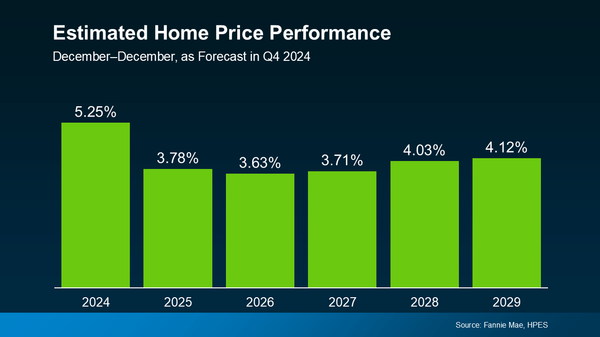

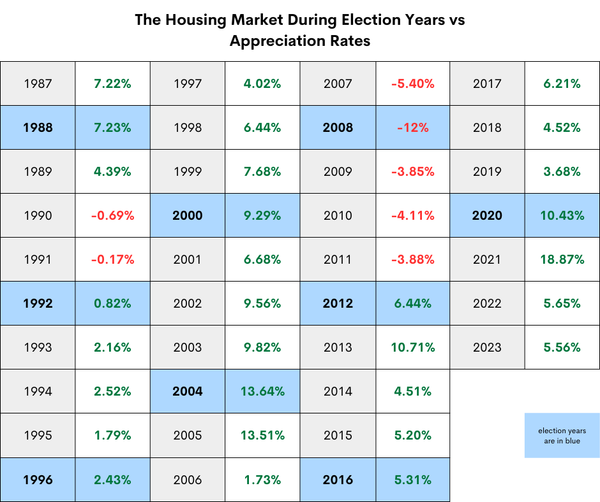

Graham Team Housing Market Update • Summer 2024 • Las Vegas & Henderson, NV The latest housing figures for Southern Nevada paint a complex picture of market dynamics, showcasing both notable shifts and enduring trends. Let’s examine some key metrics: Median Home Price: $475,000 ⬆ YOY* 7.7% in 2nd Qtr. over 2.1% in 1st Qtr. # of Homes Sold (2nd Qrt): 6,833 ⬇ YOY (3.5%) | June 2024 was down (8%) from June 2023 Inventory: ⬆ YOY 11.7% in 2nd Qtr. over 23% in 1st Qtr. Mortgage Rate: ⬇ YOY (.70%) in 2nd Qtr. over (.40%) in 1st Qtr. *YOY = year-over-year Interpreting the Trends: The housing market in Southern Nevada is navigating contrasting trends. Despite increased inventory (+11.7%) and fewer transactions (-8%), home prices continue to rise, albeit at a moderate pace compared to previous years when supply was more limited. Demand remains resilient despite growing supply. Long-Term Trends and Insights: For the last two years we have been tight on inventory supply, and the number of transactions slowed in 2023 carrying into 2024. In June we saw a significant increase in supply, bringing us to 2 months of inventory. When you are working with a low denominator, adding a couple hundred homes to the market makes the increase percentage seem high. By contrast, if we look back to pre-pandemic inventory levels which were double what they are today, adding several hundred homes would barely affect the percentage increase. It's important when you consider % adjustments to look at the underlying numbers to see if the % increase or % decrease is truly significant. Here's a 5 year look back at the Las Vegas housing market data: Homebuyers from 2023 did well with a median equity gain of $35,000 on a single-family home. We were recently asked what the many concerns are for potential sellers: If they sell their current home at a 2.75 to 3.5% mortgage, even with substantial equity in the sale of their existing home, their new home payment would be more than double if they upsize and equal, or slightly more if they downsize. That’s a big challenge for many sellers, as it doesn’t make financial sense. With low inventory, would they find the right home that checks all their boxes? Item 1 above is a significant challenge, but regardless, it doesn’t stop life from occurring and the historical reasons why people sell remain the same. Babies are still being born, and you truly can only fit so many kids in one bedroom. Changes in jobs, marriages, deaths – or needing a single-story vs two-story for health reasons. We have seen a dramatic decline in sellers who want vs. those who need a change in their home. There has also been a significant rise in first-time investors. Our Property Management team receives multiple calls each week about homeowners who want to retain their home at the super low mortgage rate and purchase another home for either need or want. My family taught me the value of investing in rental homes – for retirement income and stability – and it was a lesson I’m glad I learned early in life. I’m excited to see a whole new generation of investors doing the same. Switching a family home into an investment property is not for everyone, as it requires a change in mindset to see your home (that you may have lived in for years, raised a family, and have amazing memories in) as an asset instead. Affordability is still the #1 concern for future homeowners and will affect sellers as well. Legislators, business leaders, city officials, homebuilders, and realtors are all looking for solutions to provide affordable housing in our new future. There are some great ideas being discussed and some not-so-great solutions, but the bottom line is people need to be able to afford to live. What's Affecting the 2024 Housing Market in Las Vegas? Mortgage Rates: We started to see the rate declines that economists were predicting for the 1st quarter happen in the 2nd quarter instead. Mortgage rates ended at around 6.25% for FHA loans, 6.3% VA and 6.5% conventional mortgage in the 2nd quarter. The graph below from Freddie Mac shows conventional mortgage rate trends for the last year on a national level – Nevada tends to run .30 higher than the national average. The above graph is from Freddie Mac (https://www.freddiemac.com/pmms) Note: Conventional rates have been running 0.5% higher than FHA and VA. Good News Continues: Inflation continues to moderate. JP Morgan’s outlook reported: CPI fell by 0.1% in June 2024 (month-over-month) and rose 3% year-over-year Nationally, shelter prices declined slightly Decline in fuel prices Positive job reports JP Morgan looks for the Fed to start cutting rates in September. Affordability: The gap between the median income in Southern Nevada and the income required to qualify for the median home price is widening even further. Using the predictions below, we have forecasted the income required to qualify for a home purchase over the next 3 years. Note: Assumes Conventional loan, 5% down payment, 33% of household income applied toward house payment (PITI). Only 33.1% of Southern Nevadans currently have a median household income sufficient to afford the median sales priced home. According to a graph provided by Applied Analysis, this figure is projected to move up to about 40% in the next five years. Check out all of our Lender Resources to help you buy a home. National Law Change in Buyer’s Representation Commission: Effective August 1st in our Las Vegas Realtor Association, seller consideration for buyer’s representation commission will not be offered. This will be a significant change for buyers as they will now set the amount their agent is being paid to represent them. Previously, the compensation was set and paid by the seller. We were concerned about how this would affect our VA buyers as under VA loan guidelines they are not allowed to pay commission for their representation. However, in June the VA revised the rules and now VA buyers may pay their agent for representing them. It makes sense that buyers should determine the amount their agent is paid for working for them, but it will take some time for loan programs, appraisal values and rules to work through this. We have prepared, researched, and worked hard to develop a system where we feel that our buyers will succeed. Rental Market in Las Vegas The median rent for a single-family home rose by $100 on average, and the median lease rate now stands at $2,200 for a +/- 1,835 sf home. The median price-per-square foot is $1.23, with new homes or updated homes still obtaining a premium. Days-on-market (time it takes to lease a home) went down quarter-over-quarter to 18 days. We were recently asked the following question by a potential renter: “You cannot still be requiring 3x the monthly rent for income? There is no way the average person can do that.” Housing Snapshot Housing snapshot of 2nd Quarter, 2024: Our Takeaway What is expected for the rest of Summer? Sales Prices: Flat; We may see weeks where prices fluctuate up and down slightly. Interest Rates: Slight decrease; conventional in the mid 6% range. FHA and VA in the lower 6% range. Foreclosures: Very slight increase due to the amount of credit card debit and student loan debt. Inventory: To hover between 2-3 months. Rental Rates to Flatten: Maintain the median price of $1.15 to $1.20. Buyer Opportunities Moderate Selection: Inventory will continue to rise slightly, giving buyers more options. Be Prepared: We have many buyers who are waiting for rates to be closer to 6% before making a home purchase, as the debt-to-income ratios do not work for qualifying at today’s rate. We have been telling our future buyers to GET PREPARED! Do all that you can now to be ahead of the wave when rates drop. There are a few simple steps future buyers can take to give themselves better options and more competitive rates if mortgage rates finally fall. We’ve held a lot of buyer consultations this last quarter which has allowed our clients to action these small steps, including moving their credit score (even those with excellent credit can move up), because the stronger your credit score, the lower your interest rate. +/- Out-of-Pocket Expenses Very few over-appraisals value offers. Sellers are willing to contribute to the buyer’s closing costs & buyer’s agent representation commission. Sellers are willing to accept offers with programs with down payment assistance. We closed several homes with these programs in 2nd quarter and expect to do more in 3rd quarter. More Favorable Terms Repair requests will be more evenly considered now. Buyers can really think about the homes they tour and decide on the best one for them, with no pressure to make a same-day decision. Competing with less multiple offers. Longer close of escrow (COE) periods. If you are on a lease and need time to coordinate the end of your lease term closer to the COE, we have successfully negotiated longer dates so it reduces costs and gives you more time, therefore relieving stress. Affordability: Never buy more home than you can afford. We don’t want our clients to be house poor. Financial Advisors and Mortgage lenders recommend the range of 25-35% of your gross monthly income to be put towards your home mortgage payment (Principle, Interest, Tax, Insurance = PITI). For those who have the income to qualify, and providing it fits their family’s budget, buying ahead of the wave of buyers may offer the best deal. Many of our lender partners offer their clients a one-time rate adjustment within 3-to-5 years. If your budget allows, this can give you an advantage at today’s home price and then a reset when mortgage rates drop. Never speculate about rates dropping; only purchase a home that fits your budget. New Home Option: New homes continue to provide the best interest rates as builders are still offering incentives. We expect this will slow down and the incentives will drop off first, followed by mortgage rate discounts. The mortgage rate discounts being offered today range between 5-6%, with a 5-10% down payment. The most desirable new home communities will offer less incentives. We produce a weekly update of the incentives being offered by each builder. Renting Will Still Be Expensive If you rent a home for $2,200 for 3 years, you just paid your landlord $79,200 with no equity, no gain. If you really want to own a home in the next couple of years, reduce the size of home you are currently renting and put away the difference in rent. It will also prepare you for the size of home you can afford to purchase. We foresee that rents will run lower than purchasing options monthly, before appreciation and accounting for principal reduction. Seller Opportunities Price-to-market value: The market moved slightly from a seller’s market to a neutral market. Sellers who overpriced their homes sat on the market. When a home sits on the market, you lose buyer appeal and in most cases the eventual achieved price will be lower than if the home was priced to market in the first place. There’s no need to price under market, but if you price to market correctly, you can expect several offers to choose from and will be able to identify the best buyer on price, terms, and qualifications. We expect buyer activity to stay about flat through the 3rd quarter. Our Advice: Review the market comparably and be realistic with your home’s current value. Marketing your home will be extremely important. Having a high-quality online presence is crucial. Have patience: It will take longer to sell. 71% of homes sold in 30 days; we expect to see that number drop in the 3rd and 4th quarters. Buyer terms: Expect home buyers to ask for closing cost credits, contributions toward their agent commission, and reasonable repairs. We are seeing a lot more seller-occupied homes on the market. Have a showing schedule that accommodates the most amount of buyer traffic, which will result in more and better offers. Post Occupancy for our sellers: We can negotiate terms that allow the seller to remain in the home for up to 60 days (sometimes longer, depending on the buyer’s mortgage), which allows our sellers to make stronger offers on their home purchases. It also takes the stress out of Sellers worrying about a contingency deadline on their new home purchase. By offering a post-occupancy option for our sellers, we eliminate this stress from the sale. Questions or Comments? Contact us: Graham Team Real Estate | 702-930-9551 | team@grahamteamnv.com www.grahamteamnv.com

Rent or Sell Your Home: Which is Best?

Deciding Whether to Rent or Sell Your House When it’s time to move, deciding whether to sell your house or rent it out is a significant choice. Should you cash in for your next chapter, or hold onto the property for potential future gains? Many homeowners grapple with this decision, and finding the right answer involves weighing various factors, including potential rental income and the duties of a landlord. Here are some important considerations to help guide your decision: Is Your Home Suitable for Renting? Not every home is cut out for the rental market. Factors such as location, the condition of the property, and the distance you’ll be moving can impact the practicality of renting it out. If managing the property from afar seems daunting, or if the home requires substantial repairs to be rental-ready, selling might be the preferable route. Are You Prepared for Landlord Duties? Being a landlord involves more than just receiving rent payments. It can be demanding and sometimes problematic. You might receive maintenance calls at inconvenient times or deal with tenant issues ranging from property damage to unpaid rent. Investopedia notes: “Many landlords encounter more problems than benefits. Speaking with experienced landlords and conducting a thorough cost-benefit analysis can reveal if selling might be a simpler and less stressful option.” Do You Understand the Financial Commitments? Renting out your home isn’t just about the extra income; it’s also about the costs involved. Bankrate points out several expenses to consider: Mortgage and Property Taxes: These costs continue regardless of rental income. Insurance: Expect to pay about 25% more for landlord insurance than regular home insurance. Maintenance and Repairs: Budget at least 1% of the property’s value each year for upkeep. Tenant Acquisition: Costs here include advertising and background checks. Vacancies: Unoccupied periods mean lost income. Management and HOA Fees: Hiring a property manager can help, but expect to pay around 10% of the rental income; HOA fees might also apply. Bottom Line Ultimately, the choice to sell or rent out your home hinges on your personal circumstances. Carefully weighing the benefits and drawbacks and consulting with real estate professionals can provide clarity and confidence in your decision. We’re here to help you explore all your options and choose the path that best suits your future plans. Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com 3007 W Horizon Ridge Pkwy, Ste. 210, Henderson, NV 89052

Categories

Recent Posts