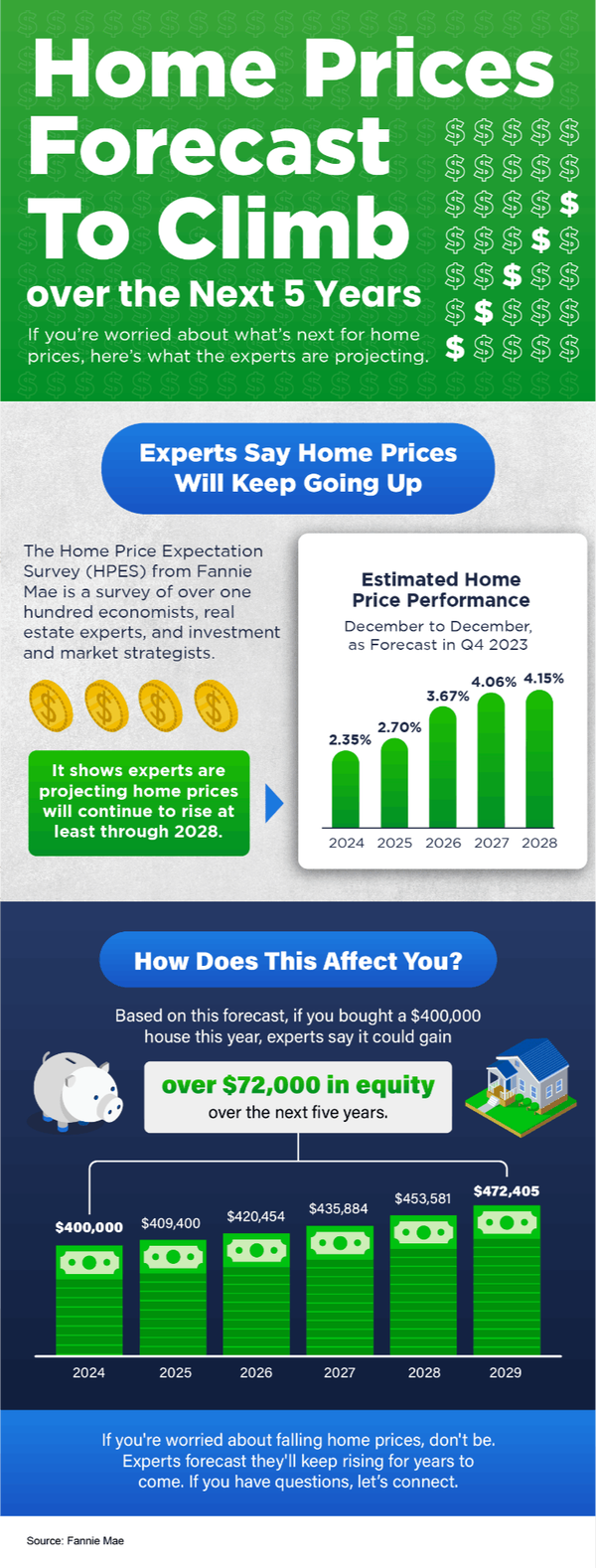

Home Prices Forecast To Climb over the Next 5 Years

If you’re worried about what’s next for home prices, know the HPES shows experts are projecting they’ll continue to rise at least through 2028. Based on that forecast, if you bought a $400,000 house this year, experts say it could gain over $72,000 in equity over the next five years. If you're wor

How Lower Mortgage Rates in 2024 Can Increase Your Home-Buying Power

Navigating Lower Mortgage Rates: Boosting Your Home Buying Power When you're in the market for a new home, understanding the influence of mortgage rates on your buying capacity and monthly payments is key. Good news for potential homebuyers: there's been a notable drop in the rates for 30-year fix

Top 3 Housing Market Questions Right Now

Are you like a lot of people wondering about the current state of the housing market? With various opinions from friends, news, and social media, it's easy to feel overwhelmed. If you're considering a move, you might find yourself with several unanswered questions. A reliable local real estate agent

Categories

Recent Posts