Las Vegas & Henderson Housing Market Update | August 2023

It's that exciting time again where we bring you the latest insights into the dynamic world of real estate. Our team has been diligently tracking trends, analyzing data, and attending industry conferences to ensure you're equipped with the most up-to-date information. Buckle up, because we're about to dive into some compelling findings that will impact your decisions as a buyer or seller.

Buyer Insights

We've surveyed over 10,000 buyers in our database, and the results are in: the primary concern that has caused buyer demand to plateau is Interest Rates. The reality is that interest rates significantly influence a buyer's purchasing power, and right now, many potential buyers are cautious due to this prevailing uncertainty.

You might wonder, with buyer demand remaining steady, why haven't we seen a decrease in home prices? The answer is simple but multifaceted: limited inventory and a curious twist of fate. Many potential buyers are also existing homeowners who are waiting for interest rates to dip before listing their homes. This waiting game is keeping inventory low, thus preventing a potential flood of sellers. However, there's a looming question: what if mortgage rates continue to rise?

The Waiting Game and Mortgage Rates

Sellers are holding off on significant life decisions because of the tantalizing promise of lower interest rates. The question is: how long can they hold off on making such decisions based on the hope that interest rates will eventually dip below 6%? Life events such as expanding families, job transfers, and aging family members are inevitable. The risk of waiting is missing out on precious moments, but budgets are real constraints. If rates remain above 6% or even approach 8%, what will happen to these sellers?

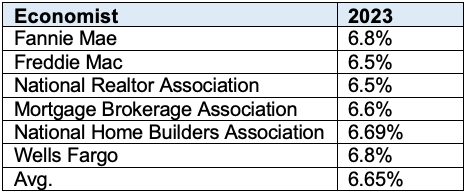

Economists' Insights and Predictions

We've consulted leading economists to gain insights into the mortgage rate landscape. Their consensus reveals that the conventional loan rate for a 30-year mortgage is projected to linger between 6.5% and 7% through 2023. This pattern is expected to continue into 2024 and beyond, with the anticipation of rates dropping further.

Their rationale centers on the Federal Reserve's anticipated actions. They predict that the Federal Funds Rate will start dropping in 2024 and continue easing its monetary policy through 2025. This shift hinges on the belief that inflation has peaked, prompting these adjustments.

Market Performance and Predictions

Home prices have experienced fluctuations, with a rebound in the latter half of 2023 after a momentary flatline earlier in the year. The median sales price for a single-family home reached $450,000 in July, stabilizing since then. While the number of homes sold in the second quarter of 2023 declined compared to previous years, recent trends are optimistic: median sale prices, median home size, number of homes sold, days on market, and inventory have all displayed positive growth.

What is trending in 2023? It’s all green so far for 2nd quarter and starting into 3rd quarter. Median Sales Price ↑ | Median Home Size ↑ | # of Homes Sold ↑ | Days on Market ↓ | Inventory ↓

The rise in the median sales price that would have normally been experienced in 1st quart due to the low inventory levels occurred in 2nd quarter. What was the change? Interest rates dropped a few times to the 6% to 6.5% range, during those periods sales activity increased dramatically.

Interest Rates

Interest Rates

The Impact of Interest Rates on the Market

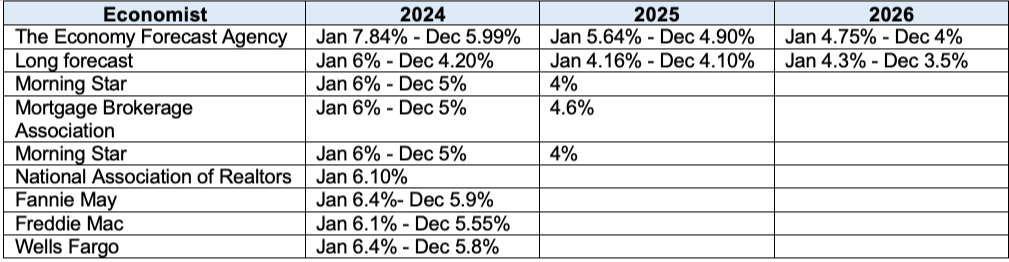

We're here to address the proverbial elephant in the room: interest rates. The 7% mortgage rate has been a stubborn obstacle affecting both buyer demand and seller activity. Our team recently attended a conference with industry experts, and they all point to a continued rate range of 6.5% to 7% in the near future. They're grounded in the belief that inflation will stabilize, and the Federal Reserve will adjust its policies accordingly. The moving into 2024 through 2026 the opinions follow the same patterns, rates expected to fall in 2024 and further into 2026.

Summary of Mortgage Rate Predictions

Note: Conventional rates have been running 0.5% higher than FHA and VA this year.

What are the factors the economists are basing their mortgage rate decisions? All of them reference the anticipated drop of the Federal Funds Rate starting 2024 and dropping further in 2025. The is based on their opinion that inflation has peaked and therefore the Federal Reserve will complete their rate hikes this fall and ease its monetary policy in 2024 and continue this ease into 2025.

The following graphs show the Federal Funds Rate since 2003 compared to Mortgage Rates. Although the Federal Reserve does not set mortgage rates, the setting of the Fund Rate does impact mortgage rate, as shown below.

Median Home Price

Median Home Price

As you can see in the graph below, for the last 3 years we have been declining in the annual number of existing home sales.

Discerning homeowners, hesitant sellers and prospective investors! Let's embark on an insightful expedition into the captivating world of home price forecasts. Despite a steady population and household formation, a pressing question arises: where are the homebuyers living? The answer lies in rentals and multi-generational living arrangements, propelled by a shortage of housing. The United States is grappling with a pronounced housing deficit, as new construction struggles to match the soaring demand. But what unfolds when interest rates take a dip, aligning with the predicted 2025 landscape? Brace yourselves for an anticipated surge in demand that could potentially inundate the market. Envision a burst of buyers descending in unison, igniting a momentary surge in housing prices. A bidding frenzy might ensue briefly, leading to an eventual equilibrium as inventory catches up. A delightful silver lining emerges for homeowners, allowing them to upsize, downsize, and finally list their existing abodes.

Behold the tapestry of national home price forecasts for the next three years: check graph!!!

- Zillow envisions home values ascending: 2023 by 3.5% | 2024 by 3.4% | 2025 by 3.3% | 2026 by 3.2%

- The National Association of Realtors (July 2023): Foresees a dip of 12.9% in 2023 from 2022, followed by a resurgence of 15.5% in 2024. (We anticipate adjustments based on current pricing averages, nationally and in Nevada.)

- Goldman Sachs contributes insights: 2023 by 2% | 2024 by 3.5% | 2025 by 4% | 2026 by 4%

- Case-Shiller projection: 2023 by 1.3% | 2024 by 1.7% | 2025 by 2.4% | 2026 by 3.8%

- Corelogic's perspective: 2023 by 3.1% | 2024 by 3.4% | 2025 by 4% | 2026 by 4%

Diving into Nevada's unique dynamics, Renofi's analysis unveils a startling revelation. Over the past decade, Nevada's housing costs have doubled. Looking ahead to 2030, the prediction is nothing short of eye-catching: the median home price in Las Vegas is expected to soar to an astonishing $621,190. This signifies an astounding 40% surge in just seven years.

Supply and Demand Dynamics

The relationship between supply, demand, and interest rates is intricate. With interest rates hovering around 7%, inventory remains low and buyer demand is somewhat restrained. But as rates approach 6%, we anticipate more sellers entering the market, leading to increased mortgage applications. Notably, recent data indicates a decline in mortgage applications over the past 60 days, which could translate to slower buyer activity in the upcoming months.

According to an article published by Redfin, 26% of homebuyers searched to move to a different metro area between May and July of 2023. Of the major metro markets, Las Vegas was the most searched for destination among homebuyers looking to relocate. Where are they moving from? California, Massachusetts, Illinois, and Washington D.C. were the top states. San Francisco clinched the #1 seat as the place where metro homeowners/buyers are feeling from.

Affordability

The disparity between the median income in Southern Nevada and the income threshold necessary to meet the qualifying criteria for the median home price is progressively increasing. Utilizing the aforementioned forecasts, we have projected the requisite income for eligibility in home purchases within the upcoming 3 years:

- 2023: Median Sales Price $450,000 – Mortgage Rate 6.75% – Income Required $125,890

- 2024: Median Sales Price $462,500 – Mortgage Rate 4.78% – Income Required $109,380

- 2025: Median Sales Price $479,380 - Mortgage Rate 4.33% – Income Required $108,945

Note: Assumes Conventional loan, 5% down payment, 33% of household income applied toward house payment (PITI).

We have concerns that the above home price prediction in the 3% range may be unaccounted for, especially when rates drop, and the pent-up demand of buyers flood the market.

Only 33.1% of Southern Nevadans have a median household income sufficient to afford the median sales priced home. According to a graph provided by Applied Analysis, this figure is projected to move to about 40% in the next five years.

The Rental Market

The median rent for a single-family home has followed the sales market remaining relative flat since 1st quarter. The median lease rate is $2,150 for a +/- 1,833 sf home. The median price-per-square foot is $1.19 with new homes or updated homes still obtaining a premium. The days on market (time it takes to lease a home) has went down quarter-over-quarter sitting at 20 days.

As a reminder from our last report, most landlord qualifications require 3x the rent of monthly income. From the household income graph mentioned earlier, this means less than 47% of households in Southern Nevada can afford the median rent.

Housing Snapshot • July 2023

Let’s review a snapshot of what happened in the 2nd quarter of 2023:

Our Takeaway

What’s in store for the rest of 2023?

Sales Prices: While we don't foresee a repeat of the rapid price jumps witnessed from May to July, we anticipate a relatively stable market with median sales prices fluctuating modestly. Maintaining within $5,000 to $10,000 of the current median sales price of $450,000.

- Interest Rates: Until the bond market levels off and core inflation goes down, interest rates will stay around the 7% mark. However, as soon as these figures move in the right direction, we could see mortgage rates drop to 6% rather quickly.

- Foreclosures: Very low rates. We do see a rise in consumer credit card debt and lower saving account balances in the US. However, the equity in homes is substantial for homeowners to lose to foreclosure. With inventory level at record low levels, Sellesr can sell and still capture equity if they had to sell.

- Inventory: We expect the number of homes on the market to remain low, however, the day on market to rise slightly as Buyer demand is weakened in 3rd quarter.

- Rental Rates to Flat: Maintain the median rate of $1.15 to $1.20.

Buyer Opportunities

- Moderate Selection: Buyers will have less to chose from. We expect they will have more time make a decision in 3rd quarter than they did in 2nd quarter where we saw multiple offers on homes, especially those priced under $450,000.

- Be Prepared: We have many buyers who are waiting for rates to be closer to 6% before making a home purchase, as the debt-to-income ratios do not work for qualifying at today’s rate. We have consistently advised our prospective buyers to GET PREPARED! Do all that you can now and be ahead of the wave when rates drop. There are a few straightforward actions that future buyers can take to secure more competitive rates and optimal choices once mortgage rates adjust. We’ve held a lot of buyer consultations this last quarter which allowed our clients to do the small things. This includes moving their credit score (even those with excellent credit can move up), because the stronger your credit score, the lower your interest rate. Being well-prepared positions you ahead of those buyers who are waiting for interest rates to decrease.

- Less Out-of-Pocket Expenses

- No more offers exceeding appraised value.

- Sellers are increasingly open to contributing towards buyer's closing costs.

- Sellers willing to accept offers with programs with down payment assistance.

- More Favorable Terms

- Repair requests will be more evenly considered now.

- Buyers can really think about the homes they tour and decide on the best one for them, no pressure to make a same day decision.

- No competing with multiple offers

- Longer close of escrows periods. If you are in a lease and need time to coordinate the end of your lease term closer to the COE, we have successfully negotiated longer dates so it reduces costs and gives you more time, therefore relieving stress.

- Affordability: Never buy a home that stretches beyond your means. We never want our clients to be house poor. Financial advisors and mortgage lenders generally recommend allocating between 25% to 35% of your gross monthly income towards your home mortgage payment (Principle, Interest, Tax, Insurance, PITI). For those who have the income to qualify, and it aligns with their family’s budget, buying ahead of the wave of buyers may get them the best deal. Many of our lender partners offer their clients a one-time rate adjustment within 3 to 5 years. If your budget allows this, it can give you the advantage at today’s home price and then a reset when (if) mortgage rates drop. Never speculate on rates dropping only purchase a home that fits your budget.

- New Home Option: New homes continue to give the best interest rates as builders are still offering incentives. We anticipate a gradual reduction in these incentives, starting with the first and followed by mortgage rate discounts. The mortgage rates discounts offered today range between 5% and 6%, with down payments ranging from 10% to 5%. The most highly desired new home communities will be offering less incentives. We have a weekly update of the incentives being offered by each builder.

- Renting Will Still Be Expensive

- If you rent a home at $2,150 for 3 years, you would have paid your landlord $77,400 without accumulating any equity or gains.

- If you really want to own a home in the next couple of years, reduce the size of home you are currently renting and put away the difference in rent. It will also prepare you for the size of home you can afford to purchase. We foresee the rents will run lower than the purchasing options on a monthly basis, before appreciation and accounting for principal reduction.

Seller Opportunities

Price-to-Market Evaluation: Even though the period from May to July exhibited a slight shift towards a Seller's market, we still observed instances where Sellers who priced their homes too high experienced prolonged time on the market. When a property lingers on the market, its appeal to potential Buyers diminishes, often resulting in a final sale price lower than if the home had been accurately priced from the start. Striking a balance is key—there's no need to underprice, but pricing in line with the market can generate multiple offers, allowing you to choose the best Buyer based on price, terms, and qualifications. However, we anticipate a reduction in Buyer demand during the third quarter, based on the current mortgage application rates.

Here's our advice:

- Evaluate Comparable Market Data: Assess the data from comparable properties on the market and be realistic about your home's present value.

- Effective Marketing: Effective marketing is paramount. Establishing a strong online presence is pivotal to attracting potential Buyers.

- Exercise Patience: Selling may take longer in the current market. In the second quarter, when Buyer demand was higher, 68% of homes sold within 30 days. We anticipate a decrease in this number in the third quarter. If your home is priced in line with the market, plan for around 60 days to sell. Overpricing could lead to a significantly longer selling period. Your home might attract numerous tours before receiving a Buyer's offer, as Buyers tend to explore various options before deciding.

- Buyer Negotiations: Anticipate that potential Buyers will likely request closing cost credits and repairs as part of their offer.

- Seller-Occupied Properties: We've observed an increase in Seller-occupied homes on the market. Through skillful negotiation, we can arrange terms that permit the Seller to remain in the property for up to 60 days (and sometimes longer, contingent on the Buyer's mortgage). This strategy empowers our Sellers to submit more robust offers when purchasing their next home. Additionally, it alleviates stress associated with Buyer contingencies, especially loan-related ones. Given the stricter standards and increased documentation requirements set by lenders, along with potential staff shortages, negotiations for a post-occupancy option alleviate these concerns for Sellers during the selling process.

Questions or comments? Contact Us:

Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com

Instagram | Facebook | YouTube | LinkedIn | TikTok

980 American Pacific Dr. Ste. 111 Henderson, NV 89014

Categories

Recent Posts