Understanding Today's Mortgage Rates for Homebuyers

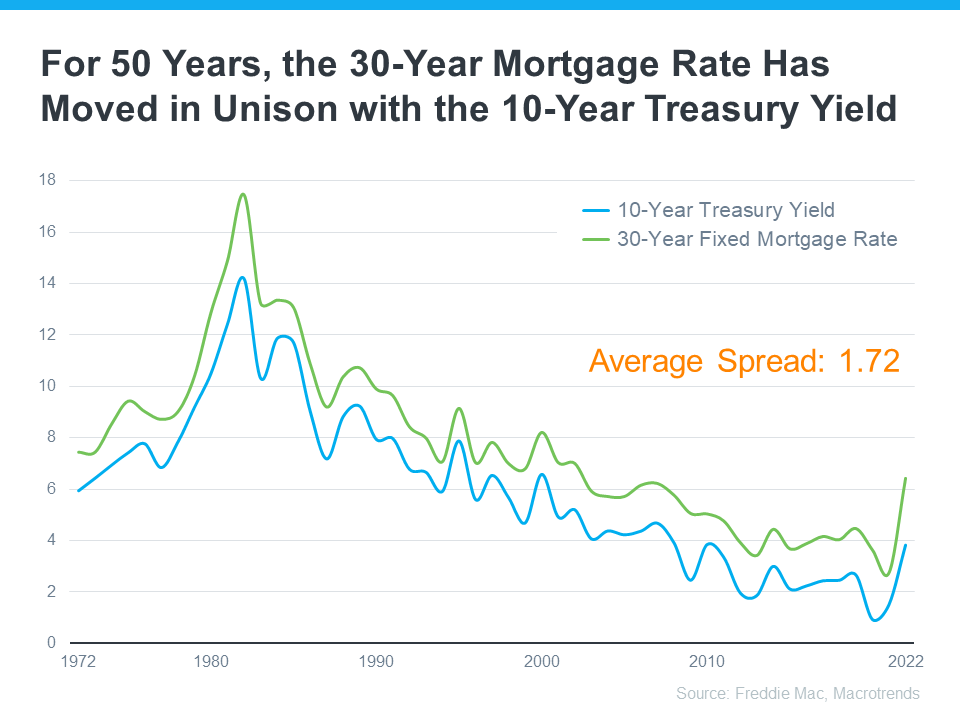

If you're keeping an eye on mortgage rates because they affect your borrowing costs, you're probably curious about what's in store for them. Predicting mortgage rates is notoriously difficult, however, there's a neat trick that has historically given us a good indication of where rates might be heading. That's the relationship between the 30-Year Mortgage Rate and the 10-Year Treasury Yield. Check out this graph that goes all the way back to 1972 when Freddie Mac started keeping mortgage rate records.

Over the past 50 years, the average difference between the two rates has been about 1.72 percentage points (that's 172 basis points). When you look at the trend line, you can see that when the Treasury Yield goes up, mortgage rates tend to follow suit. And vice versa – when the Yield drops, mortgage rates usually do too. They've been moving together like this for quite a while.

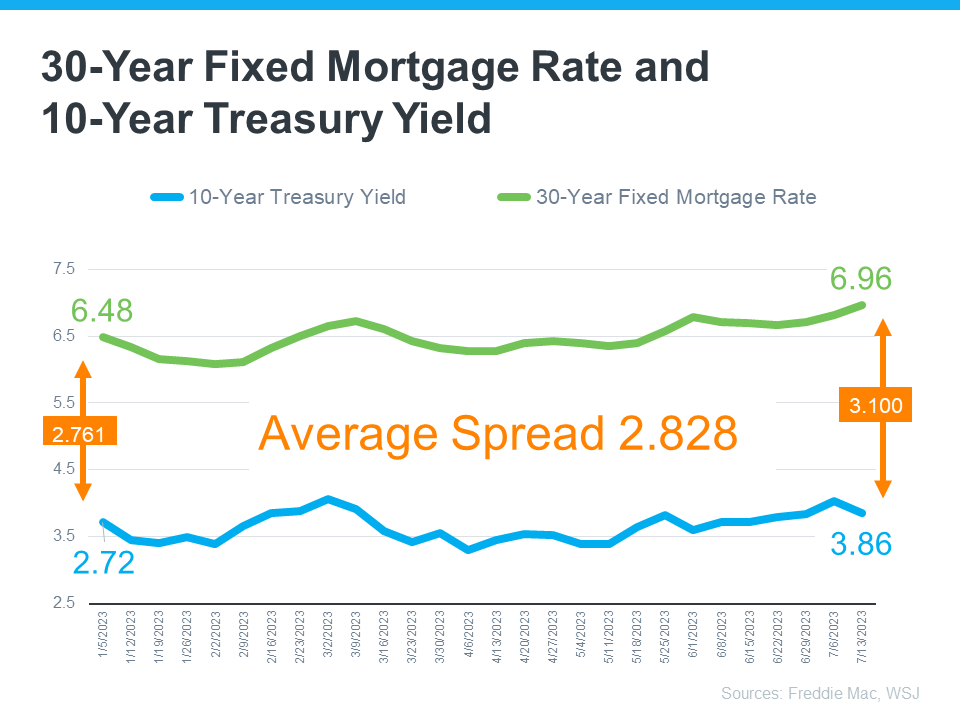

Now, here's where things get interesting. Lately, that typical spread of 1.72 percentage points has been widening way beyond the norm (check the graph below).

You might be wondering, what's causing this deviation? Well, it's primarily because of all the uncertainty in the financial markets. Factors like inflation, other economic drivers, and the decisions made by the Federal Reserve (The Fed) are all playing a role in influencing mortgage rates and causing this wider spread.

Alright, so why should you, as a homebuyer, care about all this technical stuff? Because understanding the spread can be important for you. Based on historical patterns, there seems to be room for mortgage rates to improve today.

Experts seem to agree! Odeta Kushi, Deputy Chief Economist at First American, thinks that as long as inflation cools down, we can expect the spread and mortgage rates to retreat in the latter half of the year. However, she also believes that the spread won't likely return to its historical average of 170 basis points due to some lingering risks.

Forbes also weighs in, saying that although mortgage rates might stay elevated due to economic uncertainty and the Federal Reserve's efforts to combat inflation, they expect rates to decrease to some extent later this year, barring any unexpected surprises.

So, if you're a first-time homebuyer or thinking of moving to a new place that better suits your needs, it's a good idea to keep a close eye on mortgage rates and what the experts think will happen in the upcoming months. Understanding these trends could save you some money in the long run!

Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com

Instagram | Facebook | YouTube | LinkedIn | TikTok

980 American Pacific Dr. Ste. 111 Henderson, NV 89014

Categories

Recent Posts