Explained: Why Mortgage Rates are Soaring and When to Expect Relief

Today, many homebuyers are concerned about the current mortgage rates. If you're a first-time buyer or looking to sell your current house and move into another home, you might be asking yourself two important questions:

1. Why are mortgage rates so high?

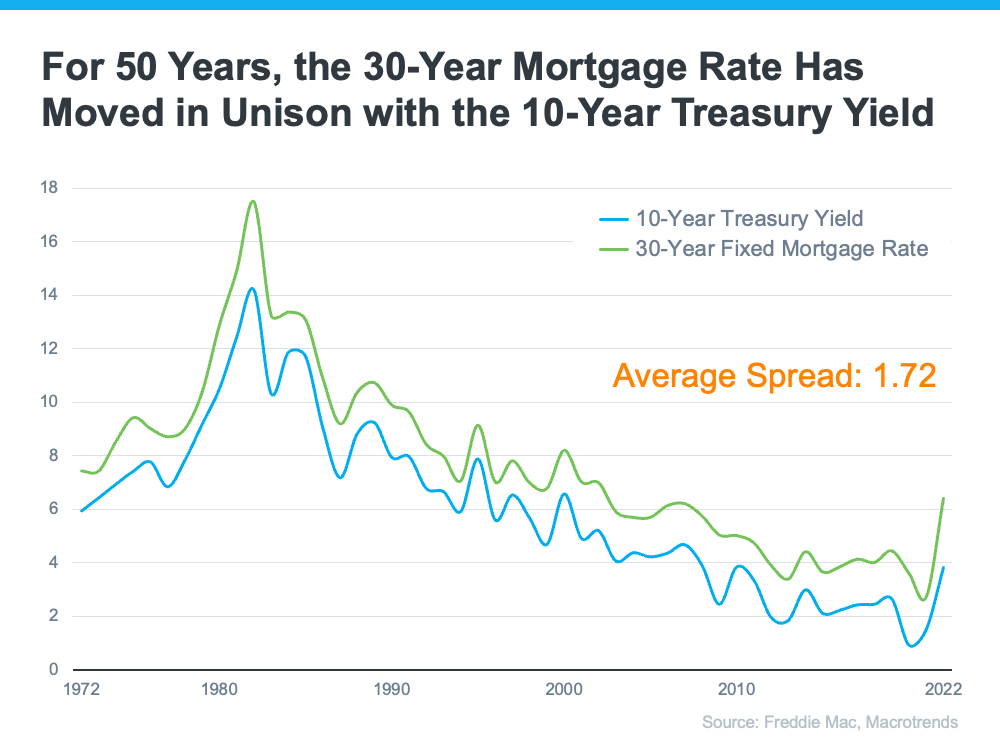

The 30-year fixed-rate mortgage is largely influenced by the supply and demand for mortgage-backed securities (MBS). Mortgage-backed securities are investment products similar to bonds that consist of a bundle of home loans and other real estate debt. When an investor buys an MBS, they are essentially lending money to homebuyers. The demand for MBS plays a role in determining the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate. Historically, the average spread between the two is 1.72.

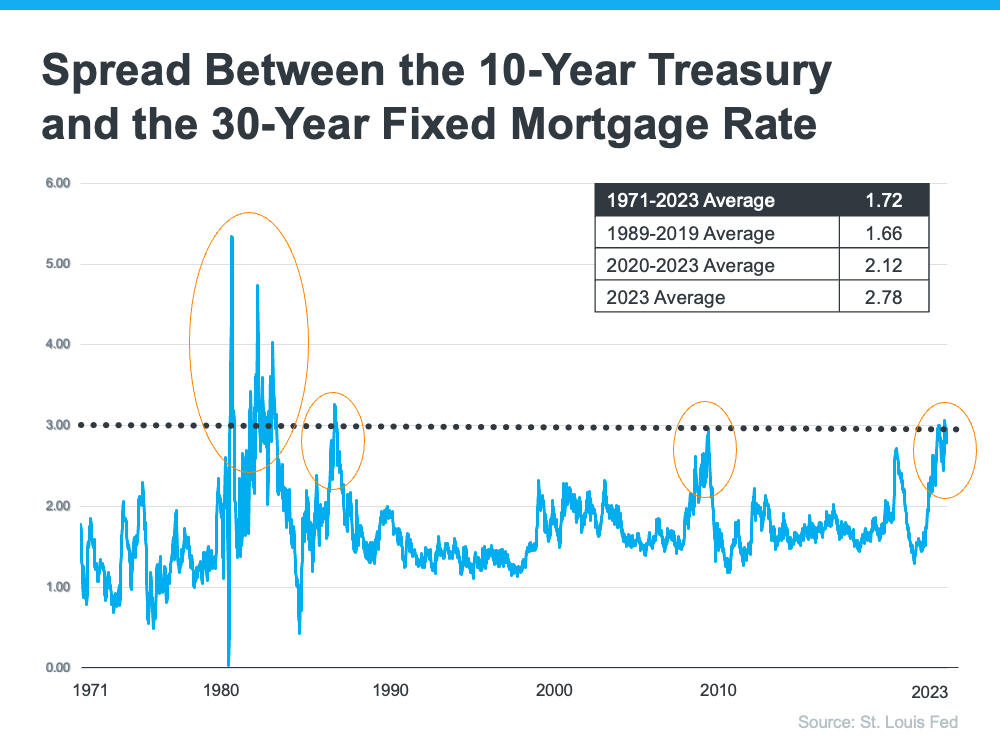

Currently, the spread is around 3.2%, which is almost 1.5% higher than the norm. This large spread is uncommon and has previously only been seen during periods of high inflation or economic volatility.

The current high mortgage rates are influenced by factors such as broader market conditions, inflation concerns, potential recession fears, interest rate hikes by the Federal Reserve, negative narratives about home prices, and more. The graph below uses historical data to help illustrate this point by showing the few times the spread has increased to 300 basis points or more:

2. When will rates go back down?

According to Odeta Kushi, Deputy Chief Economist at First American, it's reasonable to expect that mortgage rates will retreat in the second half of the year if the Federal Reserve eases its monetary tightening measures and provides investors with more certainty. However, it's unlikely that the spread will return to its historical average of 170 basis points, as some risks are expected to persist. While it's anticipated that the spread will shrink and mortgage rates will moderate as the year progresses, it's important to note that forecasting mortgage rates with certainty is challenging.

In summary, mortgage rates are currently high due to the lower demand for mortgage-backed securities, which is influenced by various market factors and perceived risks. However, it's expected that rates will go down as investor fears ease. Nevertheless, predicting exact mortgage rate movements remains uncertain.

Graham Team Real Estate • (702) 930-9551 • Team@grahamteamnv.com

Instagram | Facebook | YouTube | LinkedIn | TikTok

980 American Pacific Dr. Ste. 111 Henderson, NV 89014

Categories

Recent Posts