Housing Market 3rd Quarter 2020

We are still living in uncertain times, but housing prices continue to rise. Why?

Median Sales Price Single Family Homes is UP $337,250. This is a year over year appreciation of 8.8%. National housing prices appreciated at a rate of 14.8% the median listing price was $311,800. Las Vegas and the national housing market are experiencing record low inventory levels. Even with the low inventory levels the Las Vegas Valley sold 12.4% more homes in September 2020 than September 2019. Obviously, demand is high, and supply is low, which raises prices.

Why is there such a demand for housing in such uncertain times? We believe there are several factors driving up the housing marking the Las Vegas Valley.

- First is security. People want security when the world around them is uncertain. Owning your own home provide a secure foundation and controlling your own destiny.

- Second is rising rents. Single family home rental rates are at record highs in the greater Las Vegas Valley. This is not true for all metropolitan markets, such as New York and San Francisco, which are both seeing rental rates decline

- Third, the exodus from California is rampant. Nevada one of six states experiencing a rapid influx from California escapees.

- Fourth is record low interest rates. This quarter, we saw a numerous amount of our clients lock in rates at 2.25 to 2.75% rate. This really impacts affordability, placing mortgage rates below rental rates.

What economic figures affect the housing market?

There are some critical economic figures that should be affecting the housing market, such as lower occupancy rates on the strip down by 45%, visitor volume down by 57%, cancelled conventions and unemployment. But for the last six months, housing demand has outpaced the impact of these factors. The good news is that unemployment reduced to 12.6% in September. However, recovery to pre-Covid numbers of 3.7% are not likely until conventions return. The speculation as to why the housing market has been rising with such a high unemployment number, is sadly because the unemployment is at a higher rate for lower income levels.

Housing Snapshot

At 1.5 months of single-family home inventory, we definitely under-supplied.

What does the Graham Team anticipate for 3rd quarter 2020 housing market?

Appreciation? We had expected a flat 2nd quarter and slight rise for 3rd quarter, but we were too conservative in our estimates. Second quarter rebounded from Covid-19 impacts quickly, and June was up 3.8% year-to-date and the 3rd quarter was up another 3.8% from June. We are sticking with a conservative figure and keeping our estimate for 4th quarter. Appreciation is below 3%.

Could deprecation be a factor in 4th quarter? We do not see any economic conditions or changes that would have a significant impact on house prices for 4th quarter. The State of Nevada Eviction Moratorium lifted on October 15th. It was expected that we see a large number of eviction filings. This could impact inventory if investors look to sell. However, at this time, we have not seen high levels of investors selling, but rather many still purchasing. If owners are required to sell due to job loss, we do not expect a large wave flooding the market, but rather a steady increase of inventory. This is if the California exodus continues to flee to our market.

One large factor that will impact housing prices is seller motivation or need to sell urgently. With over 50% of the homes having 50% or greater equity nationally, sellers are financially invested in their homes. Besides, many sellers have refinanced to take advantage of the lower interest rates so they can afford the home they are in. Based upon these two factors, we do not see sellers panic or fire selling their homes at reduced prices.

– John Burns Consulting

Interest Rate Estimates: 3 to 3.5%. What goes down must go up, eventually. In 2021, we expect to see interest rates rise from these record lows. What is keeping interest rates so low? Demand. The Federal Reserve acquired one trillion dollars of mortgage back securities (mortgages) since March. When the Federal Reserve reduces it, purchase demand will shrink, and rates will rise.

Units Sold for Est. 3rd: 6,500 estimated number of single-family home sales this quarter. This estimate would reflect a 20% reduction from 1st quarter.

Buyers: Is this the right time to purchase a home?

- It is for those who were blessed not to have their income affected by the closure of non-essential businesses.

- If you can accept the potential that prices may fluctuate over the next six months, you are in for the long term and short-term fluctuation. If you stress over changes in price points no matter how small, this may not be the time for you if you are looking at the 5 to 10-year return and not the 6 months.

- You want to take advantage of these low-term interest rates, where your purchasing power is increased. The difference between a 3.25% rate and 4.25% is $35,000 in purchasing power. For many buyers, this is the difference for them to be able to afford the home in the neighborhood they wanted versus the one they could afford, or for them to have certain features like a pool.

- Assistance with closing costs: With low inventory levels, it will take a strong agent to negotiate successful closing costs assistance. We are obtaining it, but it requires negotiations and strategy to obtain.

Sellers: Timing will be important.

We are seeing more online traffic viewing our homes than ever before. Listing your home before the “Stay Home Order” is lifted can have some advantages by placing your home in front of more Buyers than it will once everyone has been set free from their homes. How can your home be kept safely listed:

- Video Walk-Throughs

- Virtual Walk-Throughs

- No in-person showings (occupied homes) until the offer is received subject to viewing. Then the ONE buyer views your home with the strictest safety protocols. No-touch policy. We show the home with gloves, masks, and sanitizer. Our team opens the doors and handles for the contract Buyer.

- Home Inspectors: Interview to ensure they have a safety protocol in place before entry. They are hired by the Buyer, but we can make sure they have a safety protocol to follow.

- Appraisers: FHA and VA are allowing drive-by appraisals and using the listing photos to complete the appraisal.

- If you want to get ahead of the masses who are holding off until next spring; being part of a smaller number of available homes, while marketing to Buyers who have more time to view homes online, could give you a strong competitive advantage.

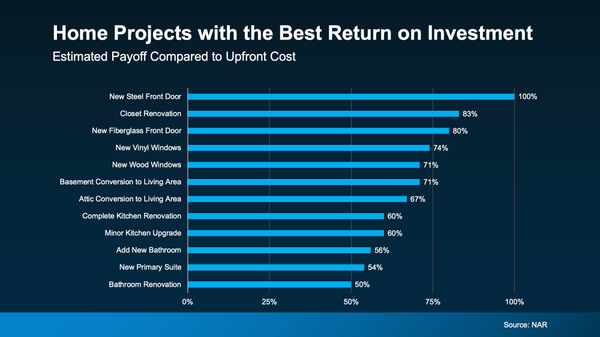

- What repairs or remodel items will bring you the greatest return when it comes time to sell? What items should you focus on when getting your home ready to sell? To the Buyer, not all repairs & home improvements bring the Seller the same value. We have put together a guidebook that helps you prepare your home to sell, outlining those home improvements that will bring you the greatest return. Visit for a free guide: Home Improvement Guide for Re-sale

Watch our market update video here!

10X Your Home

Ask about our 10X Your Home Program where we handle updating and remodel your home, including the upfront costs, which allows your home to in its best presentation and obtaining for your multiple offers to select from. Our program has put an average of $14,400 additional profit in our Sellers pockets. That no chump change!!

Categories

Recent Posts