Las Vegas & Henderson Housing Market Update | May 2024 | Spring Review

Graham Team Housing Market Update • Spring 2024

SPRING, where we normally see the housing market blossom the most, is looking to deliver mixed results. Home prices will remain relatively flat at $465,000 for the median home price for a single-family home. This is where the 1st quarter of 2024 ended. We expect inventory to pick up slightly – we mean very slightly – still below 2 months of inventory, keeping it a Seller’s Market. Interest rates rallied from 6.25% in the 1st quarter to 7.75% in April when inflation came in hotter than expected. The bond market has settled down some, and rates have started to fall, with FHA at the lower end at 6.25% heading into May.

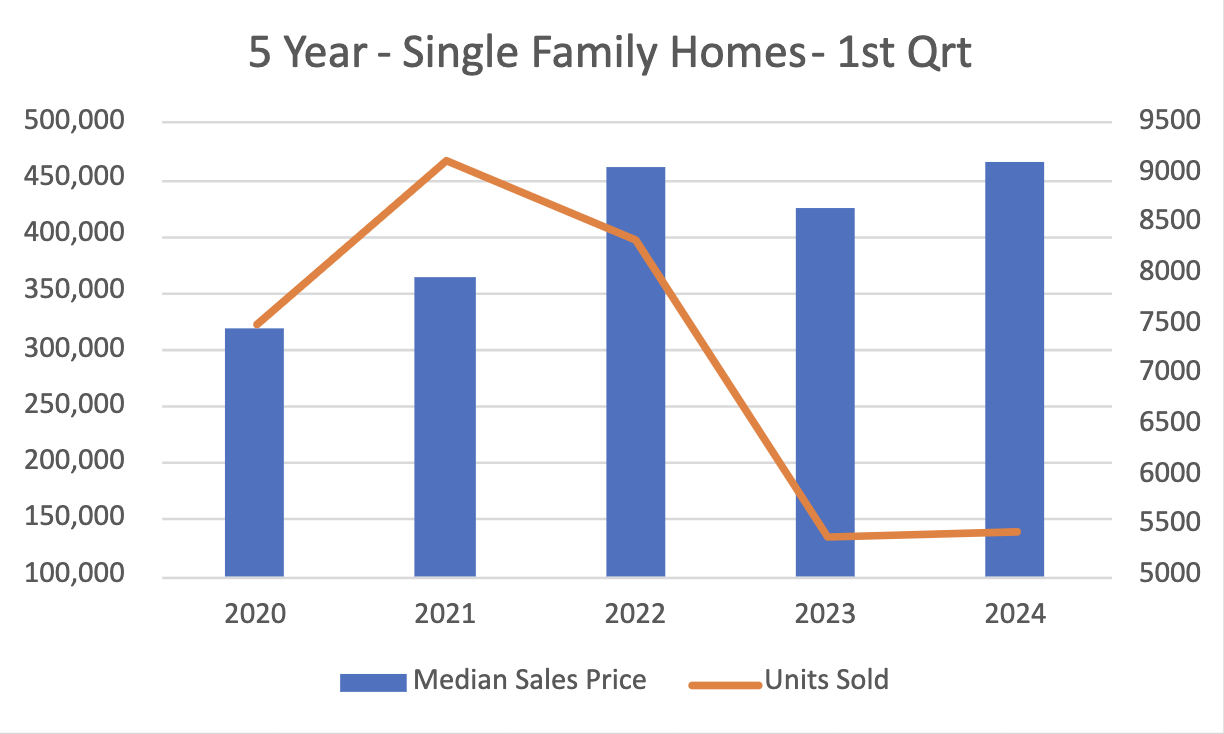

How did the numbers for the first quarter of 2024 turn out? The median sales price is up year-over-year by 9.4%, a real appreciation on the median of $40,000. Those who purchased in 2023 did well. Year-to-date, the market is up 3%. The number of homes sold in Q1 2024 over Q1 2023 is flat, almost at the same number. Interest rates have been the driving factor in both seller and buyer activity. When rates drop below 7%, we see a significant rise in mortgage applications, which typically results in increased sales 2 months later.

Why are interest rates significantly impacting sellers? Most sellers secured their current mortgage when rates were at record lows. So, even if they are looking to downsize, their payment could be higher, making them second guess their timing. Right now, most of the seller activity we are seeing is from people relocating out-of-state, those upsizing who need a larger home to meet their household needs, or those who have substantial equity and are not impacted by mortgage rates. We have also seen a rise in first-time investors who want to retain the value of their low mortgage rate and lease their existing home, while purchasing a new home for their family.

The largest impact on the housing market is still the concern of affordability. Even with this significant concern, home prices are expected to rise through the remainder of 2024. Many of our clients ask us how this is possible – if people cannot afford homes, how can prices continue to go up? The basic economics of supply and demand on the national market means we are at a 23-year low of housing inventory.

| Single-Family Homes | 1st Qrt 2024 | 1st Qrt 2023 | 1st Qrt 2022 |

| Median Sale Price | $465,000 | $425,000 | $460,000 |

| No. of Sold Units | 5,457 | 5,408 | 8,347 |

| % Sold less than 30 days | 62% | 50% | 82% |

| Months of Inventory | 1.6 | 1.8 | 0.6 |

| Sold Price to List Price | 93% | 90% | 95% |

| Flat from Previous Year | Gain from Previous Year | Decline from Previous Year |

Trends for 1st Quarter 2024 and into Spring: Median Sales Price: ↑ with pricing expected to rise slightly through to the 2nd qtr. | # of Homes Sold: Flat | Days on Market: ↑ | Inventory: ↓ 10% from 2023, flat for 1st qtr. heading into 2nd qtr. 2024

Core Factors Affecting The Market

MORTGAGE RATES

The housing market’s nemesis in 2024 was higher-than-expected mortgage rates. We started the 1st quarter of this year with rates showing a nice trending decline, then *boom*, in February we obtained bad inflation figures, and rates jumped up. We saw a slight reprieve in March, and then in April another unexpected inflation report came in jumping rates as high as 8%. As we mentioned earlier, rates into late April have started to decline from these record highs. FHA and VA came in this week at around 6.25% and Conventional around 7%.

Above graph is from Freddie Mac (https://www.freddiemac.com/pmms) and reflects conventional loan rates nationally. Blue is a 30-year mortgage rate and green is a 15-year rate. Note: Conventional rates have been running 0.5% higher than FHA and VA

GOOD NEWS: inflation figures appear to be leveling off on some of the core figures and we expect to see this have a relatively quick impact on mortgage rates. In fact, this week's drop is most likely in response to the inflation data that was recently released. Federal Reserve officials announced on May 1 that they are keeping their benchmark rate unchanged, citing a halt in progress toward reducing inflation. The bond market typically responds ahead of the Fed announcement unless the Feds take them by surprise, which is not typical.

AFFORDABILITY

The gap between the median income in Southern Nevada and the amount of income required to qualify for the median home price is widening. Using the predictions below, we have forecasted the income required to qualify for a home purchase over the next 3 years.

| Median Sales Price | Mortgage Rate | Income Required | |

| 2023 | $450,000 | 6.75% | $125,890 |

| 2024 | $462,500 | 4.78% | $109,380 |

| 2025 | $479,380 | 4.33% | $108,945 |

Note: Assumes Conventional loan, 5% down payment, 33% of household income applied toward house payment (PITI).

We have concerns that home price prediction in the 3% range may be unaccounted for, especially when rates drop, and buyers flood the market.

Only 33.1% of Southern Nevadans have a median household income sufficient to afford the median sales priced home. According to a graph provided by Applied Analysis, this figure is projected to move up to about 40% in the next five years.

Rental Market

The median rent for a single-family home has followed the sales market, remaining relatively flat since Q1. The median lease rate is $2,100 for +/- 1,841 sf home. The median price-per-square foot is $1.16 with new homes or updated homes still obtaining a premium. The days-on-market (time it takes to lease a home) has increased quarter-over-quarter to 27 days (almost 4 weeks).

As a reminder, most landlord qualifications require 3x the rent of monthly income. From the household income graph mentioned earlier, this means less than 47% of households in Southern Nevada can afford the median rent.

Housing Snapshot

Snapshot of 1st Quarter 2024:

Our Takeaway

What is expected this Spring?

- Sales Prices: Appreciate around 1-2%, with a jump when mortgage rates drop closer to 6%.

- Interest Rates: Slightly decreasing; conventional in the mid 6% range.

- Foreclosures: Very low rates. With credit card debt increasing and student loan payment deferral at an end, we expect that foreclosures will slightly increase.

- Inventory: We expect the number of homes on the market to remain low; however, the days-on-market lower from March through June.

- Rental Rates to Flatten: Maintain the median price of $1.15 to $1.20.

Buyer Opportunities

- Moderate Selection: Inventory to remain low and with a predicted jump up in buyer activity in the Spring. When rates decline, buyers could be facing a multi-offer competition, but only a couple per home (nothing like the 2021 frenzy).

- Be Prepared: We have many buyers who are waiting for rates to be closer to 6% before making a home purchase, as the debt-to-income ratios do not work for qualifying at today’s rate. We have been telling our future buyers to GET PREPARED! Do all that you can now to be ahead of the wave when rates drop. There are a few simple things future buyers can do to provide themselves with the best options and more competitive rates if mortgage rates finally fall. We’ve held a lot of buyer consultations this last quarter which has allowed our clients to do the small things. This includes moving their credit score (even those with excellent credit can move up), because the stronger your credit score, the lower your interest rate.

- Less Out-of-Pocket Expenses

- No more over-appraisal value offers unless a home has sizzle and pop.

- Sellers are willing to contribute to the buyer’s closing costs.

- Sellers are willing to accept offers with programs with down payment assistance.

- More Favorable Terms

- Repair requests will be more evenly considered now.

- Buyers can really think about the homes they tour and decide on the best one for them, and no pressure to make a same-day decision.

- No competing with multiple offers.

- Longer close of escrow (COE) periods. If you are on a lease and need time to coordinate the end of your lease term closer to the COE, we have successfully negotiated longer dates so it reduces costs and gives you more time, therefore relieving stress.

- Affordability: Never buy more home than you can afford. We don’t want our clients to be house poor. Financial Advisors and Mortgage lenders recommend the range of 25-35% of your gross monthly income to be put towards your home mortgage payment (Principle, Interest, Tax, Insurance = PITI). For those who have the income to qualify, and it fits their family’s budget, buying ahead of the wave of buyers may provide them with the best deal. Many of our lender partners offer their clients a one-time rate adjustment within 3-to-5 years. If your budget allows, this can give you the advantage at today’s home price and then a reset when mortgage rates drop. Never speculate about rates dropping; only purchase a home that fits your budget.

- New Home Option: New homes continue to provide the best interest rates as builders are still offering incentives. We expect this will slow down and the incentives will drop off first, and then the mortgage rate discounts. The mortgage rate discounts being offered today range between 5-6%, with a 5-10% down payment. The most highly desired new home communities will be offering less incentives. We have a weekly update of the incentives being offered by each builder.

- Renting Will Still Be Expensive

- If you rent a home for $2,150 for 3 years, you just paid your landlord $77,400 with no equity, no gain.

- If you really want to own a home in the next couple of years, reduce the size of home you are currently renting and put away the difference in rent. It will also prepare you for the size of home you can afford to purchase. We foresee that rents will run lower than the purchasing options on a monthly basis, before appreciation and accounting for principal reduction.

Seller Opportunities

Price-to-Market Value: even in the Spring, the market moved slightly towards a seller’s market. Sellers who overpriced their homes sat on the market. When a home sits on the market, you lose buyer appeal for the home and the eventual achieved price in most cases will be lower than if you priced the home to market. No need to price under market. If you price to market, you will have several offers to select from and will be able to identify the best buyer on price, terms, and qualifications. We expect buyer demand to decrease in the 3rd quarter based on mortgage application rates today. Our Advice:

- Review the market comparably and be realistic with your home’s current value.

- Marketing your home will be extremely important. Having a high-quality online presence is crucial.

- Have patience: it will take longer to sell. 68% of homes sold in 30 days; we expect to see that number drop in the 3rd and 4th quarters. In the Springtime, you can expect 30 to 45 days; fall and winter closer to 2 months. If you price over market, it will take quite some time. Your home will get a lot of tours before a buyer offer is received. Buyers want to see many options before deciding on a home.

- Buyer terms: expect home buyers to ask for closing cost credits and repairs.

- We are seeing a lot more seller-occupied homes on the market. We can negotiate terms that allow the seller to remain in the home for up to 60 days (sometimes longer, depending on the buyer’s mortgage), which allows our sellers to make stronger offers on their home purchases. It also takes the stress out of the buyer’s contingency, especially loan contingency. Lenders are tightening their standards and requiring a lot more documentation. Many lenders have reduced staff, so they are not hitting their time frames. By negotiating a post-occupancy option for our sellers, we eliminate this stress from the sale.

As always, if you have any questions about this report or would like more information about your neighborhood, contact us below:

Graham Team Real Estate Advisors

(702) 930-9551 • www.GrahamTeamNV.com • Team@GrahamTeamNV.com

B.0143551.LLC

Categories

Recent Posts